UNIT 10 SAVINGS ACCOUNTS NOTES QUIZ DATE TEST DATE

2 REPORT ON TITLE TO COAST CAPITAL SAVINGS CREDITA RESOURCE FOR FREESTANDING MATHEMATICS QUALIFICATIONS SAVINGS FACTS &

APPLICATION FOR MEMBERSHIP IN A TAXFREE SAVINGS ACCOUNT

ASK THE EXPERT ENERGY SAVINGS PERFORMANCE CONTRACTING PAGE

ASK THE MASTER GARDENERS – SUMMER SAVINGS BACKYARD GARDENERS

BUDGET IMPACT REVENUE OR SAVINGS OR (EXPENSE) ENFORCE METERS

UNIT 10: SAVINGS ACCOUNTS NOTES:

Quiz Date: Test Date: Graded Assignment:

Day 1:

Saving Money

Why Should I Save Money?

There are many great reasons to save money. You may want to save your money to buy something specific such as a new video game or a new shirt. If you’re really thinking ahead, you might even be saving for college. It’s also good to get into the habit of saving money in case something comes up where you’ll want or need money quickly.

How Do I Save Money?

There are many ways to save money. You can put it in a piggy bank in your room. You can also have your parents help you open up a savings account at the bank. Many times, banks will pay you interest for keeping your money with them.

What is a Savings Plan?

If you are really serious about saving money, you should come up with a plan and stick to it. You’ll need to decide where to save your money. You’ll also have to figure where your money is coming from. Do you get an allowance from your parents? Do you do jobs to earn money? Finally, you’ll want to decide how much you’ll want to save each time you earn money. You can save a certain amount or a percentage – whatever you decide is up to you. Just be sure you stick with your plan.

1. List three reasons why you might save money:

a. _______________________________

b. _______________________________

c. _______________________________

2. Where are two places you could save your money?

a. ________________________________

b. ________________________________

3. What is a savings plan? _____________________________________________ _____________________________________________ _____________________________________________

4. Maria wants to save for a new DVD that she really wants. It costs

$20. She has $4 already. She gets $5 per week for allowance.

She knows that she needs to use her allowance for any spending

money she wants during the week. Plus, once a week she can

help her neighbor with yard work for $5. She wants to know how

long it will take her to save up enough money for her DVD?

5. Matt needs to save $1500 for a security deposit for an apartment.

He makes $185 a week at his job. He has to make his car

payment once a month for $225 and also spend $65 a week on

gas and other expenses. How many weeks will it take for him to

save $1500. If he starts saving the 1st week in March, will he

have enough money saved by July 1st?

6. Anthony wants to buy a car. He found one that he likes and the

cost is $1250. Anthony has $700 saved in his savings account,

though he only wants to use $600 of it for the car. He makes $60

a week at his part-time job at Wegmans. How long will it take

Anthony to save enough money to purchase the car and how

much money will he have left in his savings account after the

purchase?

If the three people above would have been saving money earlier on, would they have had to worry about how long it will take to save for what they want????

Unit 10 Homework 10H1

Compare rates at 4 local banks for Savings Accounts and checking accounts for a Balance of $1000.

For this you need a computer or web accessible cell phone. Clearly state the bank name and regular savings account rate for each bank.

Day 2: Bank Savings Account

A safe and easy way to save your money is with a bank savings account. A bank savings account allows you to deposit money (add money to your account) or withdraw money (remove money from your account) at any time. In return for keeping your money at the bank, the bank pays you money, also known as interest.

Interest will be earned on the money you have on deposit at the bank. Since you may deposit or withdraw money each day, the bank will calculate how much money you should receive in interest. You will also receive a periodic statement from the bank listing your deposits, withdrawals, interest, and account balances. Each bank may pay a different amount of interest, so it makes sense to look at several banks to decide which one to use.

For example, if you have $500 and save it in a bank savings account, and the bank pays 1.5% interest, then in one year you will have an extra $.00 in interest, or $ in total. Therefore, the bank paid you $5.00 for saving your money with them. In summary:

Beginning Savings Interest Rate Interest Savings in one year

$500.00 1.5% $ 7.50 $507.50

For each of the following beginning savings balances and interest rates, finish filling in the following table. Round each calculation to the nearest penny.

|

|

|

Beginning Savings |

|

Interest Rate |

|

Interest |

|

Savings in one year |

|

|

|

1. |

$60.00 |

|

1.20% |

|

$____ |

|

$____________ |

|

|

|

2. |

$160.00 |

|

1.6% |

|

$____ |

|

$____________ |

|

|

|

3. |

$120.00 |

|

1.1% |

|

$_____ |

|

$____________ |

|

UNIT 10: Interest Rates

I. For each of the following beginning savings balances and interest rates, finish filling in the following table. Round each calculation to the nearest penny.

|

|

|

Beginning Savings |

|

Interest Rate |

|

Interest |

|

Savings in one year |

|

|

|

1. |

$3010.00 |

|

.7% |

|

$21.07 |

|

$____________ |

|

|

|

2. |

$690.00 |

|

.1% |

|

$0.69 |

|

$____________ |

|

|

|

3. |

$560.00 |

|

.08% |

|

$0.448 |

|

$____________ |

|

|

|

4”

|

$820.00 |

|

1.1% |

|

$_____ |

|

$____________ |

|

|

|

5. |

$1000.00 |

|

1.19% |

|

$______ |

|

$____________ |

|

|

|

6. |

$510.00 |

|

1.10% |

|

$______ |

|

$____________ |

|

|

|

7. |

$2,190.00 |

|

1.9% |

|

$______ |

|

$____________ |

|

|

|

8. |

$3,030.00 |

|

1.3% |

|

$_____ |

|

$____________ |

|

|

|

9. |

$3,280.00 |

|

1.12% |

|

$______ |

|

$____________ |

|

|

|

10. |

$920.00 |

|

1.14% |

|

$______ |

|

$____________ |

|

Day 3: Bank Savings Account Book

The following transactions were made to Emily's bank savings account:

|

|

|

|

|

|

Answer the following questions:

1. In the month of FEB, how much did Emily withdraw? $_______________

2. How much did Emily deposit in total? $_______________

3. How much did Emily withdraw in total? $_______________

4. What was Emily's highest balance? $_______________

5. After interest was added to the account on MAR 28 how

much did Emily have in the account? $_______________

6. In the month of APR, how much did Emily deposit? $_______________

7. What was Emily's lowest balance? $_______________

8. How much did Emily receive in interest in total? $_______________

9. How much did Emily have in the account after the withdrawal

on FEB 17? $_______________

10. After interest was added to the account on FEB 28 how

much did Emily have in the account? $_______________

Day 4: Introduction to Earning Interest Over Time

Saving money at a bank or other institution that takes deposits allows you to store your money with someone else. The money that you earn for doing this is called Interest. Interest is a percentage of the amount you have on deposit that you get on an annual, monthly or quarterly basis, as a payment for allowing them to hold your money, and use it to lend to others. The more money you deposit, and the longer you keep the money deposited, the more interest you will earn, and the larger your account balance will grow.

Mackenzie's bank pays 1.6% a year interest on the previous year's balance. For the first year, Mackenzie had $5,000.00 on deposit at the bank. If each year Mackenzie does not withdraw any money, finish filling in the following to see how much money Mackenzie will end up with after 8 years. Multiply each year's beginning balance by the interest rate and then calculate the new total balance. Round each calculation to the nearest penny.

|

Beginning Balance: |

$5,000.00 |

|

|

TOTAL |

|

|

Interest earned in Year 1: |

$________ |

|

$_____________

|

|

NEW TOTAL $ __________ |

Interest earned in Year 2: |

$ ____________ |

|

$ _______________ |

|

NEW TOTAL $ ___________ |

Interest earned in Year 3: |

$ ____________ |

|

$ _______________ |

|

NEW TOTAL $ ___________ |

Interest earned in Year 4: |

$ ____________ |

|

$ _______________ |

|

NEW TOTAL $ ___________ |

Interest earned in Year 5: |

$ ____________ |

|

$ _______________ |

|

NEW TOTAL $ ___________ |

Interest earned in Year 6: |

$ ____________ |

|

$ _______________ |

|

NEW TOTAL $ ___________ |

Interest earned in Year 7: |

$ ____________ |

|

$ _______________ |

|

NEW TOTAL $ ___________ |

Interest earned in Year 8: |

$ ____________ |

|

$ _______________ |

|

|

|

|

|

|

|

What was the total interest earned in 8 years? $ _______________ |

Day 5: Bank Savings Account

|

|

|

|

|

|

|

|

|

|

|

|

Day 6: Types of Savings Accounts :

CDs, Money Market Accounts, Government Investments, and IDAs

In addition to traditional savings accounts, these tools can help you save money for the short- and long-term.

1. Certificate of Deposit (CD)

CDs are timed deposits that earn interest. Money saved in a CD with your bank is deposited for a certain amount of time and earns interest when it matures (when the term is up).

CDs can be good places to save your money if:

You are saving for a big purchase planned for a year or two away.

You want your money to be safe and earn more interest than a savings account can offer.

You will not need to access your funds during the term of the CD.

CDs typically earn higher interest rates than other types of deposit accounts, such as checking and savings accounts, but your money is off-limits until the CD matures. If you cash-out a CD before it matures, you may pay a penalty.

Generally, the longer the term of a CD, the higher the interest rate will be. Terms vary from one month to five years.

2. Money market accounts

A money market account is a type of savings account. Money market accounts often pay higher interest rates than traditional savings accounts, though sometimes money market accounts have higher minimum balance requirements.

You can usually withdraw cash from a money market account and write checks from the account. However, you may be limited to making between three and six withdrawals or checks per month and pay a penalty for going over that amount.

Money market accounts can be good places to save your money if:

You will need access to your cash in the short-term.

You will not need to withdraw from the account more than a few times per month.

3. Government investments

The U.S. government sells investments, including Savings Bonds and Treasury Bills, to the public. It uses the money raised to run the federal government and pay its debts.

Government savings bonds and treasury bills are safe and secure investments, because the U.S. government guarantees that interest and principal payments will be paid on time.

a. U.S. Savings Bonds

Here is a basic overview of of U.S. Savings Bonds:

There are two kinds of

savings bonds:

—Series EE are

guaranteed to double in 20 years

—Series

I pay a fixed rate of interest adjusted for inflation

Bonds are long-term securities & earn interest for up to 30 years.

Bonds are available in denominations of $50 to $10,000.

Interest can vary, but you always get a minimum return.

Interest income is subject to federal income tax (but not state or local tax).

You may defer tax on the interest until the bonds are cashed in.

b. U.S. Treasury Bills (T-bills)

Here is a basic overview of T-bills:

T-bills are short-term securities that mature in one year or less from their issue date.

They are sold at a discount from their face value, so you make money because you are paid the full face value at maturity.

They are available in increments of $100.

Interest income is subject to federal income tax (but not state or local tax).

You can learn more, purchase savings bonds or treasury bills, and find current and historical rates online at the Treasury Direct Web site.

4. Individual Development Account (IDA)

IDAs are special savings accounts that help low-income families save money to pay for important things like college, a home, or a business.

Certain private and public organizations agree to match contributions to IDAs, helping people save more toward a college education, home, or business of their own.

IDAs typically only allow three uses:

Purchasing a first home

Pursuing post-secondary (college) education

Starting or expanding a small business

Most people who have IDAs also take part in money management classes to help them repair their credit, create a budget, and stick to a savings plan.

Looking for an IDA program in your area? The Corporation for Enterprise Development has an online directory of IDA programs nationwide.

5. Other key terms… What is FDIC insurance?

The Federal Deposit Insurance Corporation (FDIC) is an independent agency of the United States government created to protect depositors in the event a bank fails and cannot refund their money. It is, literally, an insurance policy that participating banks pay for to protect consumers. If a bank is unable to reimburse depositors, the FDIC steps in and does it for the bank—up to $250,000 per ownership type (single or joint). It is important to remember that the FDIC coverage levels for individual accounts are expected to return to the $100,000 limit on January 1, 2014.

Day 7: Types of savings accounts and current interest rates:

Compared to a regular savings account, there are many different types of savings accounts you can open to prepare for future expenses or help grow your wealth.

These include:

College savings (529 plans)

Individual retirement accounts

Rewards savings

Joint savings accounts

Health savings

High-yield savings accounts, also known as high interest savings accounts

Plans like 529 plans or IRAs are meant for particular purposes, such as saving for college or retirement.

Many accounts may qualify for tax-free savings, including health savings accounts. The IRS defines a health savings account as an account that is designed to pay or reimburse you for medical expenses. Having a health savings account has several tax benefits, including tax-free interest or other earnings in the account.

Current April 2016 Rates:

Bank Account Interest Rates for Savings, Checking & CDs from Bank ...

https://www.bankofamerica.com/deposits/bank-account-i... Proxy Highlight

Bank account interest rates increase your funds with a steady return. Find out today's CD, checking and savings account rates from Bank of ... Current State.

COSTBENEFIT ANALYSIS OF LEAD HAZARD CONTROL REVEALS SIGNIFICANT SAVINGS

DECREE ON THE SAVINGS DEPOSITS SUBJECT TO INSURANCE AND

ESPAÑOL E INGLÉS COVER COPY PAYROLL SAVINGS BROCHURE (SB2242)

Tags: accounts notes:, many accounts, notes, savings, accounts

- STOPPING AUTOMATIC DEBIT PAYMENTS – SAMPLE REVOCATION LETTER TO

- CARAVAN SITES AND CONTROL OF DEVELOPMENT ACT 1960 PERMANENT

- CONSTRUCCIÓN DE TABLAS DE FRECUENCIAS DE DATOS NO AGRUPADOS

- EDIZIONE N 1 TICKET RESTAURANT IL NUOVO SISTEMA DI

- JOHN NAPIER (15501617) BARÃO ESCOCÊS NAPIER FOI TEÓLOGO

- CÁLCULO DIFERENCIAL TAREAS DE LA UNIDAD TRES TAREA NO

- 16 EVALUATION OF HEALTH EDUCATION PROGRAMMES STUDY SESSION 16

- ERRORES FRECUENTES EN TRANSMISIONES DE MANIFIESTODECLARACIÓN DE INGRESO (E9)

- REGULATION OF GMO CROPS AND FOODS KENYA CASE STUDY

- ACTIVIDAD DE VOCABULARIO PARA 2º ESO EXCEPTUANDO LOS TEMAS

- NR ÎNREGISTRARE SOLICITANT NR ÎNREGISTRARE IT ISCIR ……………

- HIGHFIDELITY DESIGN METHODS TO DETERMINE KNOCKDOWN FACTORS FOR THE

- CUESTIONARIO SME ARQUITECTOS E INGENIEROS ESTE CUESTIONARIO ES UN

- ESTIMATED SELLING PRICE DIRECTOR APPROVED INFORMATION THAT MUST

- ADVANCES IN FAST 2D CAMERA DATA HANDLING AND ANALYSIS

- ENDLESS WAIT FOR OMATEK DIVIDEND APART FROM THE DASHED

- ORIGEN HISTORICO FUNDACION CASINO EL CASINO DE ELCHE SE

- Dpkocpdddcpo2003001 Dpkomd0300994 Dpkocpdddcpo2003001 Dpkomd0300994 Directives for Disciplinary Matters

- ROLE OF THE GUT IN VISCERAL FAT INFLAMMATION AND

- REGULAMENT CONCURS DE ELEGANȚĂ SINAIA – 29 IUNIE 2019

- FORM –

- AL MEDIODÍA EL SOL CONVIERTE EL LUGAR EN UN

- PARAIŠKA VEKSELIUI I DALIS PRAŠOMA SUMA

- DEPARTMENT OF VETERANS AFFAIRS M211 PART V SUBPART I

- FIN 335 EXAM III SPRING 2008 FOR DR GRAHAM’S

- “PUSE LA FRENTE ENTRE LAS OLAS PROFUNDAS DESCENDÍ COMO

- CARTAS EMPRESARIALES CARACTERÍSTICAS SE REMITEN FUERA DE LA

- 4 ANSWER TRUE OR FALSE TO THE NEXT 15

- GRANT CONTRACTS AWARDED DURING DECEMBER 2008 FINANCING SOURCE [DCIALA19189]

- AUTOSHAPE 11 AUTOSHAPE 11 AUTOSHAPE 11

STIEBEL ELTRON KONTAKT KARRIERE FACHPARTNERSUCHE

BIBLIOGRAFÍA SOBRE METODOLOGÍA Y TÉCNICAS DE INVESTIGACIÓN REGISTRO 1

REGULAMIN 33 EDYCJI KONKURSU REGULAMIN 33 OGÓLNOPOLSKIEGO KONKURSU

FICHA DIAGNÓSTICO LEGALAMBIENTAL PLAN INTEGRAL DE SEGURIDAD ESCOLAR PLAN

FICHA DIAGNÓSTICO LEGALAMBIENTAL PLAN INTEGRAL DE SEGURIDAD ESCOLAR PLANREGULATIONS ON THE IMPLEMENTATION OF THE EEA AND NORWEGIAN

S EDEŽ BIRO AIA INŽENIRING DOO AIA INŽENIRING DOO

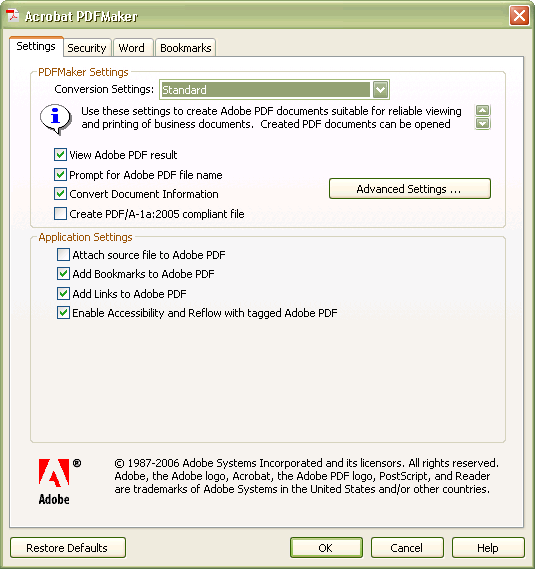

S EDEŽ BIRO AIA INŽENIRING DOO AIA INŽENIRING DOO WORD TO ACCESSIBLE PDF (USING WORD 2003 & ADOBE

WORD TO ACCESSIBLE PDF (USING WORD 2003 & ADOBECEMETERIES AND CREMATORIA SERVICE CORONAVIRUS INSTRUCTIONS FOR FUNERAL

43003 AC 15053206D CHANGE 3 SUBJECT AIRPORT PAVEMENT DESIGN

43003 AC 15053206D CHANGE 3 SUBJECT AIRPORT PAVEMENT DESIGN10144 CHAPTER 23 REGULATIONS GOVERNING THE LICENSING AND FUNCTIONING

COMMENTAIRE DE L’ARTICLE 3 ALINÉA 1IER DE LA CONSTITUTION

SOL·LICITUD UTILITZACIÓ INSTAL·ACIONS EDIFICIS I DEPENDÈNCIES MUNICIPALS SOL·LICITANT NOM

MANUAL DE PROCEDIMIENTOS LILDBIWEB VERSIÓN PRELIMINAR DICIEMBRE 2001

MANUAL DE PROCEDIMIENTOS LILDBIWEB VERSIÓN PRELIMINAR DICIEMBRE 2001PRICE CHANGES ALBERTA PRINTED CIRCUITS FIRST OFFERED OUR PROTOTYPE

2 FINANSŲ SKYRIUS PAŽYMA DĖL LIETUVOS CENTRO PARTIJOS 2011

COMPRAS Y LICITACIONES LLAMADO A COMPRA DIRECTA PUBLICACIÓN N°

COMPRAS Y LICITACIONES LLAMADO A COMPRA DIRECTA PUBLICACIÓN N° LEARNER RESOURCE 3 HOW ARE CRIME AND DEVIANCE

LEARNER RESOURCE 3 HOW ARE CRIME AND DEVIANCE BRAD SIDRICK EXPERIENCE (CONTINUED) PAGE 3 LEGACY ENGINEERING LLC

BRAD SIDRICK EXPERIENCE (CONTINUED) PAGE 3 LEGACY ENGINEERING LLCVILLAGE OF NORTH BRANCH LAPEER COUNTY MICHIGAN ORDINANCE NO

ÖREBRO SWEDEN 2527 APRIL 2022 GUIDELINES AND TEMPLATE FOR

ÖREBRO SWEDEN 2527 APRIL 2022 GUIDELINES AND TEMPLATE FOR