A DECISION SUPPORT TOOL FOR SOCIALLY RESPONSIBLE CONSCIOUS INVESTORS

4 DECISION 252 SISTEMA DE INFORMACIÓN8 DECISION 562 DIRECTIVES FOR THE PREPARATION

FINDINGS AND DECISION FILE NUMBER MC085 APPLICANT PRONGHORN

(200607) VOLUME 21 INLAND REVENUE BOARD OF REVIEW DECISIONS

(200708) VOLUME 22 INLAND REVENUE BOARD OF REVIEW DECISIONS

(201011) VOLUME 25 INLAND REVENUE BOARD OF REVIEW DECISIONS

A Decision Support Tool for Socially Responsible Conscious Investors

A Decision Support Tool for Socially Responsible Conscious Investors

Alexei Gaivoronski (Dep. of Industrial Economics and Technology Management, Norwegian University of Science and Technology)

Blanca Pérez-Gladish (Dep. of Quantitative Economics, University of Oviedo, Spain)

Paz Mendez (Dep. of Quantitative Economics, University of Oviedo, Spain)

Abstract

Socially Responsible Investing (SRI), also known as sustainable or ethical investing, corresponds to an investment practice that takes into account not only the usual return-risk criteria, but also other non-financial dimensions, namely in terms of environmental, social and governance concerns. Recently, given the causes of the 2008 financial crisis, these concerns became even more relevant. However, while a diverse set of models has been developed to support investment decision-making based on financial criteria, models including also socially responsible criteria are rather scarce. In this paper, we first discuss the diversity of environmental, social and governance aspects that can be taken into account when analyzing mutual funds, and try to contribute to fulfill this gap on the financial literature, suggesting a multicriteria value model to analyze and rank U.S. large cap equity mutual funds members of Social Investment Forum. Second, we propose a portfolio selection model on mutual funds taking into account both, financial and SRI criteria considering also individual targets of SRI conscious investor. Financial criteria include both, return and risk targets and are based on VaR related risk measures. In addition we compare efficient frontiers that correspond to different levels of investor’s SRI consciousness that again are based on the modern risk measures like VaR and CVaR. In this way we develop a set of decision support tools for SRI conscious investor. An empirical study is carried out on socially responsible portfolio selection with the application of VaR to 110 U.S. domiciled large cap equity mutual funds (conventional and socially responsible SIF members).

Key words: Capital Markets; Socially Responsible Investment; Governance (ESG) practices, Equity Mutual Funds, Multicriteria Decision Analysis; Morningstar Rating; Value-at-Risk, Conditional Value-at-Risk.

(201213) VOLUME 27 INLAND REVENUE BOARD OF REVIEW DECISIONS

(201314) VOLUME 28 INLAND REVENUE BOARD OF REVIEW DECISIONS

(201617) VOLUME 31 INLAND REVENUE BOARD OF REVIEW DECISIONS

Tags: conscious investors, sri conscious, responsible, support, investors, socially, decision, conscious

- 47 PEDRO CALDERÓN DE LA BARCA EN LOS SIGLOS

- 3 MERKBLATT INFLUENZA 1 ERREGER DIE INFLUENZA IST EINE

- A 16 DE MARÇ DE 2020 MESURES ECONÒMIQUES I

- ZMIANY SPECYFIKACJI ISTOTNYCH WARUNKÓW ZAMÓWIENIA W SPECYFIKACJI ISTOTNYCH WARUNKÓW

- INDIANA WORKERS COMPENSATION BOARD EDI IMPLEMENTATION PLAN 1

- Z AŁĄCZNIK NR 10 WNIOSEK KLUBU O WYDANIE LISTU

- RESOLUCION EXENTA N°36 DEL 24 DE AGOSTO DEL 2001

- LONGITUDINAL OPTICAL COHERENCE TOMOGRAPHY FINDINGS IN A CASE OF

- CAN WE PREDICT DIFFERENCES? SUMMARY STUDENTS WILL PREDICT PRODUCE

- 3 2 LA FISIOLOGÍA DEL SIGLO XIX EN ESTA

- ZAŁĄCZNIK NR 1 SZCZEGÓŁOWY OPIS PRZEDMIOTU ZAMÓWIENIA PAKIET NR

- AKTUALIZACJA DNIA 29102021 …………… DNIA MIEJSCOWOŚĆ IMIĘ

- CHAPTER 11 MULTIPLE CHOICE QUESTIONS 1 BRAIN STRUCTURE A

- SOLICITUD DE ENSAYO ANÁLISIS DE SUSTRATOS Y ENMIENDAS

- FORM APPR 161 IN THE INDIANA [SUPREME COURTCOURT

- LLEGA LA VIII EDICIÓN DE LAS “24 HORAS” DE

- 13 PAISAJES DESEADOS EL PAIS DE JAUJA EN LA

- PRIS PR PERSON I DOBBELTROM KR 11250 TILLEGG

- WORKING GROUP OF STRATEGIES AND REVIEW 49TH SESSION 1216

- …………………………………… ………………………………………… (PIECZĘĆ PRACODAWCY) (MIEJSCOWOŚĆ I DATA) …………………………………… (NUMER

- ASSP GREATER BOSTON CHAPTER LOCAL SCHOLARSHIPS ELIGIBILITY 1

- КАНДИДАТЫ НА ДОЛЖНОСТЬ ГЛАВЫ МУНИЦИПАЛЬНОГО ОБРАЗОВАНИЯ ГОРОДСКОЕ ПОСЕЛЕНИЕ КОНДИНСКОЕ

- HYDRAULIC PASTE FILL INCIDENT OR BARRICADE FAILURE OCCURRENCE

- BOWIE STATE UNIVERSITY BUDGET DEVELOPMENT PROCESS CALENDAR TIMELINE DUE

- R EIMBURSEMENT FOR EVS PLUGGED INTO EXISTING 120V FEDERAL

- [TYPE TEXT] GENDER PRIMER EXERCISE GENDER QUIZ

- VERSIE 20091 BIJLAGE 13 CODE AARD VAN DE DAG

- DRA SUSANA LOPEZ CHARRETON CURRICULUM VITAE FECHA DE NACIMIENTO

- FERPA OAKLAND UNIVERSITY OFFICE OF THE REGISTRAR FINAL UNDERGRADUATE

- NZQA UNIT STANDARD 31057 VERSION 1 PAGE 2 OF

UN NUEVO ESPACIO DE LIBERTAD SEGURIDAD Y JUSTICIA SONIA

03 SISTEMAS OPERATIVOS WINDOWS 7 LINUX M ÁS HERRAMIENTAS

03 SISTEMAS OPERATIVOS WINDOWS 7 LINUX M ÁS HERRAMIENTASNOMBRE ESPAÑOL 3H SEÑORITA TARVIN FECHA EXAMEN

PROCURADURIA REGIONAL DE NARIÑO ESTUDIOS PREVIOS PARA SELECCIONAR AL

PROCURADURIA REGIONAL DE NARIÑO ESTUDIOS PREVIOS PARA SELECCIONAR AL REHABILITACIÓN DE AGENCIAS POR FALTA DE ESTRUCTURA FUNCIONAL INSTRUCTIVO

REHABILITACIÓN DE AGENCIAS POR FALTA DE ESTRUCTURA FUNCIONAL INSTRUCTIVO SOLICITUD DE SEGURO COMBINADO FAMILIAR 1 TIPO DE

SOLICITUD DE SEGURO COMBINADO FAMILIAR 1 TIPO DE N IDONEIDAD DE LAS INSTALACIONES EN RELACIÓN AL ENSAYO

N IDONEIDAD DE LAS INSTALACIONES EN RELACIÓN AL ENSAYO DOUBLE REPLACEMENT REACTIONS (PRECIPITATION REACTIONS) STANDARDS ADDRESSED 8311 EXPLAIN

DOUBLE REPLACEMENT REACTIONS (PRECIPITATION REACTIONS) STANDARDS ADDRESSED 8311 EXPLAINPÁGINA 4 DE 4 A LA SALA PENAL DEL

DR JANJA HOJNIK SOODLOČANJE DELAVCEV V EVROPSKI ZASEBNI DRUŽBI

REPUBLIQUE DU BURUNDI MINISTERE DE LA SANTE PUBLIQUE SYSTEME

REPUBLIQUE DU BURUNDI MINISTERE DE LA SANTE PUBLIQUE SYSTEME1 SOCIOLOGIAS DE LA VIDA COTIDIANA1 MANUEL CANALES

HOW TO CUSTOMIZE THIS SAMPLE DRUGFREE WORKPLACE PROGRAM THE

ENTRE LA ELECCIÓN Y LA CONSTITUCIÓN DE LA NUEVA

vse Spremembe Zakona o Pravdnem Postopku Odločba o Razveljavitvi

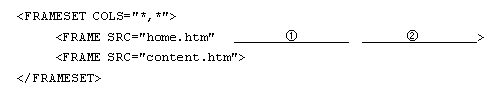

◈ 기출문제(HTML) 문제번호 1 정답 1 다음 중 웹

◈ 기출문제(HTML) 문제번호 1 정답 1 다음 중 웹 EUROPEES PARLEMENT 2014 2019 COMMISSION{CONT}COMMISSIE BEGROTINGSCONTROLECOMMISSION REFPROC20142146(INI)REFPROC DATE{25022015}2522015DATE

EUROPEES PARLEMENT 2014 2019 COMMISSION{CONT}COMMISSIE BEGROTINGSCONTROLECOMMISSION REFPROC20142146(INI)REFPROC DATE{25022015}2522015DATE2004IV SETTORESERVSOC194 OGGETTO CONVENZIONE TRA IL COMUNE DI PARMA

ZAPYTANIE OFERTOWE NR 01WB2017 KOMPASS CONSULTING BUCZKOWSKI MACIEJ STOSUJĄC

ZAPYTANIE OFERTOWE NR 01WB2017 KOMPASS CONSULTING BUCZKOWSKI MACIEJ STOSUJĄC PRESSMEDDELANDE STOCKHOLM OCH ESPOO 5 DECEMBER 2003

PRESSMEDDELANDE STOCKHOLM OCH ESPOO 5 DECEMBER 2003