VASSAR COLLEGE 403(B) RETIREMENT PLAN SUMMARY PLAN DESCRIPTION

CATURARAKKHADIPANI 《四護衛禪明燈》 FROM CHATTHA SAVGAYANA (CS) RELEASED BY DHAMMAVASSARAMAVASSAR COLLEGE 403(B) RETIREMENT PLAN SUMMARY PLAN DESCRIPTION

Vassar College 403(b) Retire Pl SPD (Faculty & Admin.)121610 (A0048273).DOC

VASSAR COLLEGE

403(b) RETIREMENT PLAN

____________________

SUMMARY PLAN DESCRIPTION

FOR FACULTY AND ADMINISTRATORS

____________________

Vassar College

124 Raymond Avenue

Poughkeepsie, NY 12604

Tel: (845) 437-7000

2011

TABLE OF CONTENTS

____________________

1. INTRODUCTION 1

2. PURPOSE OF THE PLAN 1

3. ELIGIBILITY REQUIREMENTS 2

4. CONTRIBUTIONS TO THE PLAN 2

5. FUNDING VEHICLES; INVESTMENT OF CONTRIBUTIONS 5

6. IN-SERVICE WITHDRAWALS AND LOANS 7

7. DISTRIBUTIONS AFTER TERMINATION OF EMPLOYMENT 9

8. DEATH BENEFITS 10

9. TAX CONSIDERATIONS 11

10. ADMINISTRATION OF THE PLAN 12

11. CIRCUMSTANCES AFFECTING PLAN BENEFITS 13

12. PLAN PARTICIPANT’S RIGHTS 14

13. MISCELLANEOUS INFORMATION 16

VASSAR COLLEGE 403(b) RETIREMENT PLAN

____________________

SUMMARY PLAN DESCRIPTION

____________________

This summary plan description (“SPD”) provides a brief description of the Vassar College 403(b) Retirement Plan (the “Plan”). Prior to 2010, Vassar College (the “College”) maintained three separate 403(b) plans, the Vassar College Retirement Plan for Faculty and Administrators, the Vassar College Retirement Plan for Staff Employees and the Vassar College Supplemental Retirement Account Plan. In 2010, the three separate plans were consolidated into the single plan described in this SPD. Except where specifically noted, the consolidation of the three plans has had no effect on the substantive provisions of the Plan or on any participant’s benefit.

Inside this SPD, you will find an explanation of your rights, obligations and benefits under the Plan. However, this SPD is not the actual Plan. The actual Plan is contained in a detailed legal document, a copy of which is available from the Benefits Office for review and copying by any employee who wishes to do so. In the event of any conflict between any statements in this SPD and the provisions of the plan document, the provisions of the Plan will govern.

The Plan is a defined contribution plan that operates under Section 403(b) of the Internal Revenue Code. The purpose of the Plan is to provide retirement benefits for participating employees. Benefits are provided through Fidelity Investments as well as through the Teachers Insurance and Annuity Association (TIAA) and the College Retirement Equities Fund (CREF) (referred to in this SPD as the “Fund Sponsors”). The College’s current selection of Fidelity Investments and TIAA-CREF as Fund Sponsors is not intended to limit future additions or deletions of Fund Sponsors. You will be notified of any additions or deletions.

If you have any questions about the Plan after reviewing this SPD, please contact the Benefits Office.

The Plan allows employees of Vassar College (the “College”) to save and invest a portion of their earnings on a tax-deferred basis by making salary deferral contributions to the Plan. In addition, the Plan is designed to help employees who are eligible to receive employer contributions attain financial security in their retirement years. Each plan year (January 1 – December 31), the College will make a contribution for each eligible employee, based on the employee’s compensation and age. The Plan should enable participants to achieve a significant source of retirement income, in addition to Social Security and other non-retirement plan savings.

Salary Deferral Contributions

All employees of the College, other than certain students working for the College, are eligible to participate in the Plan by making salary deferral contributions.

If you are an eligible employee, you will be able to make salary deferral contributions starting on the first day of the month following your date of hire. For a faculty member, your date of hire is the effective date of your contract; for all other employees, your date of hire is the first day on which you complete an hour of service. An eligible employee may make a rollover and/or transfer contribution (see Section 4, below) before becoming a participant in the Plan.

Employer Contributions

Job Classification – You are eligible to participate in the employer contribution portion of the Plan if you are employed by the College in one or more of the following employee classifications:

faculty;

senior officer;

administrator;

professional; or

manager.

Age and Service Requirements – The employer contribution portion of the Plan is open to all eligible employees who have attained age 26 and completed one year of service. For faculty members and administrators hired at or above the rank of associate professor, the requirement of a year of service is waived. A “year of service” is a 12-month period, starting on your hire date and anniversaries of that date, in which you are credited with at least 1,000 hours of service. For faculty members, employment on a two-thirds time basis is equivalent to 1,000 hours, and employment on a half-time basis is equivalent to 750 hours. An hour of service is generally credited for every hour actually worked by an employee and for most paid non-working hours, such as vacation, holidays and sick days.

Employer contribution participation generally begins on the first day of the month after you complete one year of service or, if later, on the January 1 or July 1 that coincides with or next follows your 26th birthday. An eligible employee may make a rollover and/or transfer contribution (see Section 4, below) before becoming a participant in the Plan.

Salary Deferral Contributions

If you have satisfied the requirements for becoming a participant, you may elect to make salary deferral contributions to the Plan. These are contributions that you make to the Plan instead of receiving those amounts in the form of taxable cash compensation. You may elect to make salary deferral contributions in any dollar amount or whole percentage from 1% up to 100% of your compensation each year. Compensation means all of the earnings subject to wage withholding that you receive from the College for services during the portion of the plan year in which you are eligible to participate in the Plan.

You may change or stop your salary deferral contributions on reasonable notice (preferably by email) to the Plan Administrator. Any salary deferral contributions you make to the Plan will be allocated to a separate salary deferral contribution account and will be subject to the restrictions and limitations that the Plan Administrator considers necessary or appropriate.

Salary deferral contributions are subject to legal limits that may restrict the maximum amount you can contribute to the Plan. One such limit is that your salary deferral contributions cannot exceed $16,500 (in 2010 and 2011, indexed for inflation). If this limit is exceeded, the Plan will refund the amount of salary deferral contributions needed to stay within the limit.

Enrollment – You may begin making salary deferral contributions to the Plan by completing and submitting an election form within a reasonable period (as determined by the Plan Administrator) before the date on which you wish to begin contributing. You may submit an election form upon becoming eligible to participate or at any later time; your election will become effective as of the first day of the first payroll period following the date on which the Plan Administrator timely receives the election form. On the form, you must indicate the percentage or amount of compensation that you wish to contribute to the Plan in lieu of receiving payment in cash. After you have submitted the form to the Plan Administrator, your future salary or wage payments will be reduced by the amount you have elected to contribute to the Plan.

Changing the Rate of Contributions – You may change the rate of your salary deferral contributions by giving advance written notice (preferably by email) to the Plan Administrator. The change will become effective in the first payroll period following the Plan Administrator’s receipt of your written notice. You may discontinue salary deferral contributions by filing a form with the Plan Administrator within a reasonable period (as determined by the Plan Administrator) before the beginning of the payroll period in which the discontinuance is to become effective.

Catch-up Contributions

If you are, or will reach, age 50 during a plan year, you may elect to make catch-up contributions to the Plan in the form of additional salary deferral contributions by submitting a completed election form to the Plan Administrator. The maximum amount that you can contribute to the Plan as a catch-up contribution for a plan year is $5,500 (in 2010 and 2011, indexed for inflation).

Before 2009, the Plan permitted certain participants who had completed at least 15 years of employment with the College to make additional contributions beyond the regular contributions and age-50 catch-up contributions. After 2008, these additional contributions are no longer permitted.

Employer Contributions

Faculty and Administrators – Contributions will be made on behalf of each eligible employee, in 12 monthly installments from July through June, in accordance with the following schedule:

Annual contribution

Attained age on July 1 as a percentage of basic annual salary

Less than 26 0%

26 but less than 30 7%

30 but less than 40 11%

40 and over 14%1

Contributions are based on your annual salary rate exclusive of any additional compensation (such as bonuses) you may receive. The amount of compensation that can be counted under the Plan is subject to a limit that is indexed for inflation ($245,000 for 2010 and 2011). Any such contributions made to the Plan on your behalf will be allocated to a separate employer contribution account and will be subject to the restrictions and limitations that the Plan Administrator considers necessary or appropriate.

You will receive an employer contribution for each plan year in which you are expected to complete a year of participation service. A “year of participation service” is a 12-month period, beginning on an anniversary of your hire date, during which you complete at least 1,000 hours of service.

Overall Limit on Contributions

There is a limit on the total contributions (College contributions under the Plan and salary deferral contributions) that may be made for a participant for any plan year under the Plan and each other 403(b) plan to which the College contributes. The overall limit is the lesser of a dollar limit which is indexed for inflation ($49,000 in 2010 and 2011) or 100% of the participant’s compensation. You will be notified if you are affected by the overall limit.

Transfer Contributions

The Plan Administrator, in its sole discretion, may permit an eligible employee (even if not yet a participant) to transfer contributions to the Plan from another 403(b) plan or arrangement. Any such contributions allowed into the Plan will be allocated to a separate transfer contribution account and will be subject to the same restrictions and limitations as applied to the contributions when they were held under the transferor plan or arrangement, as well as such additional limits as the Plan Administrator considers necessary or appropriate.

Rollover Contributions

If you have received a distribution from a retirement plan of your previous employer, you may be eligible to “roll over” that distribution to the Plan. A “rollover contribution” may be made as a “direct rollover” from your previous employer’s plan, as a transfer within 60 days after you have received the distribution from your previous employer’s plan, or in certain cases from an individual retirement account that has been used as a conduit for the distribution from your previous employer’s plan. After-tax contributions may not be rolled over into the Plan.

The Fund Sponsor that will receive the rollover contribution must approve all such contributions in advance. If you wish to make a rollover contribution, the Fund Sponsor may require you to demonstrate that the legal requirements for a rollover contribution are satisfied.

You should not withdraw funds from any other plan or account until you have received written approval from the Fund Sponsor for the rollover into the Plan.

The types of distributions that may be rolled over into the Plan include distributions from tax-qualified plans, governmental plans and individual retirement accounts that contain only funds from a previous employer’s plan. For more information about these rules, you may contact the Benefits Office or a Fund Sponsor. Any such contribution allowed into the Plan will be allocated to a separate rollover contribution account and will be subject to the restrictions and limitations that the Plan Administrator considers necessary or appropriate.

Vesting

You are always 100% vested in all contributions made to the Plan. This means that you will always be entitled to receive 100% of the value of your accounts, even if you terminate employment before retirement.

5. FUNDING VEHICLES; INVESTMENT OF CONTRIBUTIONS

The contributions you make (salary deferral contributions, rollover contributions and transfer contributions) and the College’s contributions made on your behalf are allocated to a Plan account established in your name which is held either in annuity contracts issued by TIAA-CREF or in custodial accounts established by Fidelity Investments, or both. These contracts and accounts are referred to as the Plan’s “funding vehicles”. You choose the funding vehicle(s) to which your contributions are allocated.

Under the Plan, you may invest your account in any of the investment options available under the funding vehicle or vehicles you have selected. The Plan’s menu of investment options is included in this SPD as Appendix B. This menu is subject to change as a result of periodic performance reviews. More information on the Plan’s investment options is available from the Benefits Office and also on-line at the Vassar HR, TIAA-CREF and Fidelity Investments websites:

http://humanresources.vassar.edu/benefits.retirement.menu.html

http://www.tiaa-cref.org/vassar

http:///www.fidelity.com/atwork

If you do not choose investment options for your account, your funds will be invested in the qualified default investment alternative (QDIA) offered by your Fund Sponsor. If you choose Fidelity Investments as your Fund Sponsor, your QDIA will be Fidelity’s Freedom Funds. If you choose TIAA-CREF, your QDIA will be TIAA-CREF’s Lifecycle Funds. If you do not choose a Fund Sponsor, your contributions will be split evenly between Fidelity and TIAA-CREF.

The Freedom Funds and the Lifecycle Funds are targeted for a date near your 65th birthday, and provide a mix of assets that shifts during the life of the account. In early years, the assets are weighted towards diversified equities to provide moderate growth. The assets are shifted periodically so that, as you near retirement, the portfolio becomes weighted towards fixed investments to guard against volatility at the time when the funds are withdrawn. Specific information on the assets, objectives, risks and fees of these is provided on Fidelity’s and TIAA-CREF’s websites (see above). If your account is invested in one of the Plan’s QDIAs, for purposes of Section 404(c) of the Employee Retirement Income Security Act of 1974 (ERISA), which is discussed below, your account will be considered to have been invested at your direction.

In all cases, even if your contributions are defaulted to the QDIA, you have the right to change your investment allocations at any time, using the full range of investment options available under the funding vehicles. To change your allocations, contact TIAA-CREF or Fidelity directly, either via your secure log-in on their websites or by telephone at these numbers:

TIAA-CREF: 1-800-842-2776

Fidelity Investments: 1-800-343-0860

In directing your investments, you should remember that the amount of your benefits under the Plan will depend in part upon your choice of investments. If you choose investments that produce gains and other earnings, your benefits will tend to increase in value over time. Conversely, if you choose investments that have losses, your benefits will tend to decrease in value over time. Losses can occur and there are no guarantees of performance.

The College and the Plan Administrator will not provide you with investment advice. The Fund Sponsors and their representatives may, however, advise you in accordance with Sections 408(b)(14) and 408(g) of ERISA for the provision of investment advice to participants and beneficiaries under Section 601 of the Pension Protection Act of 2006 (PPA).

The College, the Plan Administrator, the Fund Sponsors, and their representatives do not insure or otherwise guarantee the value or performance of any investment you choose. You are entirely responsible for any investment elections that you make.

Participant Responsibility for Investment Decisions – The Plan is intended to meet the requirements of Section 404(c) of the Employee Retirement Income Security Act of 1974 (ERISA) and the Department of Labor regulations implementing that provision. This means that the fiduciaries of the Plan, such as the College, may be relieved of liability for any losses that are the direct and necessary result of investment instructions given by a participant.

Certain information is given to you automatically in connection with the investment of your contributions. In addition, the following information can be obtained upon request from the Plan Administrator’s representative:

(i) a description of the operating expenses of each of the Plan’s specific investment alternatives;

(ii) information concerning the value of units or shares in the Plan’s investment alternatives and their historical performance;

(iii) a listing of assets comprising the portfolio of each investment alternative, the value of such assets (or the proportion of the investment fund which it comprises) and, with respect to each asset which is a fixed rate investment contract issued by a bank, savings and loan association or insurance company, the name of the issuer of the contract, the term of the contract and the rate of return of the contract;

(iv) copies of prospectuses, financial statements and reports, and other materials provided to the Plan regarding its investment alternatives; and

(v) information concerning the value of shares or units (if applicable) in each investment alternative in which the requesting participant has funds invested.

In general, there is a prospectus for each of the investment options available through the Plan. The prospectus sets forth the fund’s investment objectives, strategies and risks, presents historical performance figures for the fund, and describes the fund’s operating expenses. You are encouraged to read all of the prospectuses carefully so that you can choose which investment funds are best suited for you. You can get updated prospectuses and investment information for these funds by contacting the Plan Administrator or the relevant Fund Sponsor.

Each of the investment alternatives made available through the Plan may have certain operating expenses, such as management fees, brokerage commissions, transfer taxes and other expenses. Each of the expenses is, in general, deducted from the contract and/or fund and is, therefore, reflected in each investment alternative’s value. As a result, investment-related expenses are borne by the participants’ investments. Not all of the investment alternatives have the same type or amount of expenses. More specific information about the expenses incurred by each investment alternative is detailed in the relevant prospectus, which you are encouraged to read.

6. IN-SERVICE WITHDRAWALS AND LOANS

Since the Plan is regarded under the federal tax laws as a program to provide retirement benefits, withdrawals or distributions of money from the Plan before retirement are restricted and may be subject to penalty taxes (as well as regular income taxes) in certain circumstances. You should therefore treat the Plan as a means to accumulate tax-advantaged savings and to invest for the long term, and should not use the Plan to make short-term investments.

Withdrawals After Age 59½

In accordance with such procedures as the Administrator may establish from time to time and to the extent permitted by the funding vehicles, you may withdraw all or part of your salary deferral account balance under the Plan once you reach age 59½.

Rollover Contribution Withdrawal

In accordance with such procedures as the Administrator may establish from time to time and to the extent permitted by the funding vehicles, you may withdraw all or part of the balance credited to your rollover contribution account at any time.

Financial Hardship Withdrawal

Subject to the terms of the funding vehicles, if you are actively employed and suffer a “financial hardship” for one of the reasons described below, you may receive a financial hardship withdrawal from your salary deferral contributions account, rollover contribution account and transfer contribution account up to the amount needed to meet your financial obligations resulting from the hardship. Any investment income earned on your salary deferral contributions may not be withdrawn on account of financial hardship.

A financial hardship, as defined in the Plan, can result only from:

medical expenses for members of your immediate family not covered by insurance;

post-secondary education expenses of a member of your immediate family;

purchase of a principal residence for yourself;

payments necessary to prevent your eviction from your principal residence or to prevent foreclosure on the mortgage on that residence;

payments for burial or funeral expenses of your deceased parent, spouse, child or dependent; or

expenses for the repair of damage to your principal residence deductible as a casualty loss.

Hardship withdrawals are also permitted for medical, tuition (educational) and funeral expenses for your primary beneficiary under the plan. Your “primary beneficiary” is an individual who is named as your beneficiary under the plan and has an unconditional right to some or all of your account balance following your death.

Upon incurring a financial hardship, you must apply in writing to the Plan Administrator describing the nature of the hardship and the amount that you want to withdraw. The amount of any hardship withdrawal may be increased to provide for anticipated taxes and penalties. To be considered for a hardship withdrawal, you’ll need to complete an application form and supply supporting documentation required by the Plan Administrator.

Hardship withdrawals may not be rolled over to another plan or to an individual retirement arrangement. Since these withdrawals may not be rolled over, they are not subject to income tax withholding. A hardship withdrawal is, however, subject to income taxes, as well as to a 10% penalty tax if received before age 59½. Your salary deferral contributions to the Plan and all other plans of the Employer will be suspended for a period of six months after the withdrawal.

Loans to Participants

Subject to the terms of the funding vehicles, a Fund Sponsor may authorize a loan to you from your salary deferral contributions account, rollover contribution account and transfer contribution account in an amount not to exceed the lesser of 50% of the value of such accounts or $50,000. The loan must be repaid in regular installments over a period no longer than five years, unless the loan is made for the purpose of purchasing a principal residence in which case the term of the loan may be longer. The loan will bear a reasonable rate of interest. You may have only one loan outstanding at any time. To obtain a loan, you must demonstrate to the satisfaction of the Fund Sponsor that you can repay the loan in accordance with its terms, and you must sign a promissory note in favor of the Plan. Your account balance must be pledged as security for the loan.

Subject to the requirements of the promissory note, if you stop working for the College before your loan is repaid, your loan will immediately become due and payable, subject to a 60-day grace period. Any outstanding loan balance will automatically be deducted from your account before it is distributed to you.

A loan to you from the Plan is not regarded as a distribution subject to income tax. However, if you default in the repayment of the loan, you could then be treated as receiving a distribution for tax purposes, which would be subject to income tax, including the penalty tax if applicable.

Transfers

If you participate in another 403(b) plan of the College, you may be able to transfer some of your account balance under the Plan to the other plan.

7. DISTRIBUTIONS AFTER TERMINATION OF EMPLOYMENT

If you terminate your employment with the College, the amount payable under the Plan will be distributed as soon as administratively feasible following receipt of your written request for payment.

Forms of Benefit Distribution

The Plan provides for three forms of benefit distribution. However, if you are married, your right to choose a distribution option will be subject to your spouse’s right under federal pension law to survivor benefits, as discussed below, unless this right is waived by you and your

spouse. The distribution options under the Plan include:

Option A: A lump sum payment in cash.

Option B: Payments over a specified period of years, not to exceed the

participant’s life expectancy (or the joint and survivor life expectancy

of the participant and a designated beneficiary), in annual or more frequent

installments.

Option C: Annuity payments to the participant for life with, in the case of a married participant, payments continuing after the participant’s death to the participant’s surviving spouse for life in an amount equal to at least 50% of the amount paid to the participant during his or her life.

Additional distribution options may be available under the terms of the funding vehicles. Please contact the Benefits Office if you are interested in exploring your distribution options.

The Fund Sponsor will pay your benefits in accordance with Option C above, unless you have elected Option A or B and, if you are married, your spouse has consented in writing to your election. The Benefits Office, upon written request, will provide you with information regarding the available payment options and the requirements for waiving Option C.

You are entitled to elect the method for paying out your benefits. If you wish to have your benefit paid in installments, the period of the payout may be limited to comply with certain tax law requirements.

If you have any questions regarding distributions, including annuity payments, please contact the Benefits Office.

If you die after distribution of your benefit has commenced, a death benefit will be paid to your beneficiary only if so provided under the form of distribution you selected. If you die before payment of your benefit begins, your surviving spouse or other beneficiary will receive the value of your accumulation account, payable in a single sum or under one of the annuity options offered by the Fund Sponsor.

If you are married and you die before your benefit commences, benefits must be paid to your surviving spouse as a pre-retirement survivor benefit, unless your written waiver of this benefit and your spouse’s written consent to the waiver are filed with the Fund Sponsor on a form approved by the Fund Sponsor.

A waiver of the joint and survivor annuity may be made only during the 180-day period before the commencement of benefits. The waiver also may be revoked for a limited period of time. It may not be revoked after annuity income begins.

The period during which you may waive the pre-retirement survivor benefit begins on the first day of the plan year in which you attain age 35 and continues until the earlier of your death or the date on which you start receiving annuity income. If you die before attaining age 35 – that is, before you have had the option to make a waiver – at least half of the current value of your account is payable automatically to your surviving spouse in a single sum, or under one of the distribution options offered by the Fund Sponsor. If you terminate employment before age 35, the period for waiving the pre-retirement survivor benefit begins no later than the date of termination.

Spousal Consent to a Waiver

Your spouse’s consent must be in writing, must be notarized or witnessed by a Plan representative, and must contain an acknowledgment by your spouse of the effect of the consent. All such consents are irrevocable. Spousal consent is not required if you can establish to the Plan Administrator’s satisfaction that you have no spouse or that he or she cannot be located. Unless a qualified domestic relations order (“QDRO”) requires otherwise, your spouse’s consent will not be required if you are legally separated or you have been abandoned (within the meaning of local law) and you have a court order to that effect.

Your spouse’s consent to a non-spouse beneficiary must specifically identify a beneficiary or expressly permit designation of a beneficiary by you without further consent by your spouse. If a designated beneficiary dies, unless the express right to designate a new one has been granted to you, a new consent is necessary.

Your spouse’s consent to an alternative form of benefit payment (such as a single life annuity) must either specify a specific form of payment or expressly permit you to designate a payment form without further consent.

A consent is only valid if your spouse at the time of your death, or earlier benefit commencement, is the same person as the one who signed the consent.

If a QDRO establishes the rights of another person to your benefits under this Plan, then payments will be made according to that order. A QDRO may preempt the usual requirement that your spouse be considered your primary beneficiary for a portion of your accumulation account.

The discussion in this section is intended to provide general guidance with respect to the tax rules affecting you as a result of your participation in the Plan. Because of the complexity of these rules, the frequency with which they are changed and the fact that each person’s circumstances are unique, you are urged to consult with a personal tax adviser regarding the tax aspects of your participation in the Plan and the receipt of benefits under the Plan.

Tax Treatment of Contributions

In general, all of your salary deferral contributions (including catch-up contributions) are excludable from your income for federal and state income tax purposes, but these contributions are includable in your income for Social Security tax purposes. Employer contributions are not subject to any tax when made to the Plan on your behalf. Rollover and transfer contributions are not subject to tax until distributed from the Plan.

Tax Treatment of Accounts

The funding vehicles are exempt from federal and state income taxes. Therefore, any interest and dividends paid to, as well as capital gains and appreciation in value realized by, the funding vehicles are not subject to taxation until distributed from the Plan.

Tax Treatment of Distributions to Participants

In general, any distribution of benefits from the Plan to you or your beneficiary is subject to both federal and state income tax, but not Social Security tax. Several exceptions and special rules may apply, however, either with regard to the taxability of these amounts or with respect to the rate or method of computing the tax. Here are some of the more important rules and exceptions:

Pre-Age 59½ Distribution Penalty Tax. Subject to certain exceptions, distributions from the Plan made before you attain age 59½, including hardship withdrawals, are subject to normal income taxes plus a 10% federal penalty tax. The exceptions include distributions on account of your death, disability or separation from service after age 55.

Rollover of Distribution. If the distribution you receive from the Plan qualifies as an “eligible rollover distribution,” you may be able to roll over all or part of the distribution to an individual retirement account (IRA), a 403(b) annuity contract or the retirement plan of a new employer. The amount rolled over will not be subject to income taxes or to the 10% penalty tax. An eligible rollover distribution includes any lump sum payment, other than a hardship withdrawal. A surviving spouse may roll over a death benefit, and a participant’s designated beneficiary may roll over a death benefit but only to an IRA.

You may also be able to roll over all or part of the distribution to a Roth IRA. The amount rolled over will be subject to income taxes at the time of the rollover, but both the amount rolled over and future earnings on that amount will not be taxable when distributed from the Roth IRA after attaining age 59½ if at least five years have expired since the Roth IRA was established. Otherwise (with limited exceptions) the amount distributed from the Roth IRA is taxable and potentially subject to an early withdrawal penalty.

Tax Withholding. Most distributions of benefits from the Plan are subject to mandatory tax withholding, unless you elect to have a direct rollover of the benefit amount to an IRA, a 403(b) annuity contract or the retirement plan of a new employer. Before you receive a distribution, the Plan Administrator will provide a written notice explaining the rules under which you may elect to have a payment from the Plan transferred in a direct rollover.

10. ADMINISTRATION OF THE PLAN

The College is the sponsor and “Plan Administrator” of the Plan. As sponsor of the Plan, the College has the power to amend or terminate the Plan. The Manager, Benefits Programs of the College is the College’s representative for purposes of its responsibilities as Plan Administrator.

As Plan Administrator, the College is responsible for various determinations, such as whether an employee has satisfied the requirements for becoming a participant; performing administrative duties, such as ensuring that employees receive notice of their eligibility to become participants; and distributing information and filing reports with the government, such as distributing this SPD to employees and filing the Plan’s annual report on Form 5500 with the U.S. Department of Labor. Day-to-day administrative matters relating to the Plan, such as answering employees’ questions and distributing and receiving employee election forms, are also the responsibility of the Plan Administrator.

Funding

Benefits under the Plan are funded by annuity contracts or by custodial accounts holding mutual funds.

Plan Costs

The cost of operating and administering the Plan is paid by the College.

11. CIRCUMSTANCES AFFECTING PLAN BENEFITS

This SPD is intended to describe the general terms for participation and benefit distributions under the Plan. Certain exceptional circumstances, however, may result in an increase, decrease, suspension or other difference in your participation or in the amount of benefits you actually receive. The following are exceptional circumstances that could affect participation or benefits.

Assignment

Generally, your account under the Plan may not be sold, used as collateral for a loan, given away or otherwise transferred. In addition, creditors may not attach or garnish rights to benefits under the Plan. However, the Plan must pay out your benefits in accordance with a QDRO which is a court decree obligating you to pay alimony or child support, or otherwise allocating a portion of your Plan benefit to your spouse, former spouse, child or other dependent. If a QDRO is received by the Plan Administrator, all or a portion of your plan benefit may be used to satisfy the obligation created by that order. The Plan maintains procedures with respect to the administration of qualified domestic relations orders. Please contact the Benefits Office if you need a copy of these procedures.

Amendment or Termination of the Plan

The College has the right to amend or terminate the Plan at any time. However, no amendment can allow any part of the Plan to be used for purposes other than the exclusive benefit of the participants and their beneficiaries, cause any reduction to a participant’s accumulation account under his or her funding vehicles, decrease the benefit of any retired or terminated participant, or cause any part of the funding vehicles to revert to the College.

If the Plan is terminated, your accumulation account will either be paid out to you at that time or be held in the Plan for distribution when you retire or terminate employment.

Claims Procedure

Under normal circumstances, payment of your benefit will begin at the appropriate time following your retirement or death, in accordance with your or your beneficiary’s election. If you or your beneficiary believe that the correct amount of benefits is not being paid or that other treatment to which you or your beneficiary are entitled under the Plan is not being provided, you or your beneficiary must file a written claim with the Plan Administrator. The Plan Administrator will consider the claim. If the claim is denied in whole or in part, the Plan Administrator will notify the claimant within 90 days (180 days in certain cases) of the reasons for its denial with specific references to provisions of the Plan, a description of any additional material or information necessary to complete the claim, an explanation of why that material or information is necessary, and the steps that should be taken if the claimant wishes to have the decision reviewed. The claimant may appeal a denied claim within 60 days after receiving the denial notice and will have the right to review pertinent documents and to submit issues and comments in writing to the Plan Administrator.

The Plan Administrator will make a full and fair review of the claim and may require additional documents, as the Plan Administrator feels necessary or desirable to make a review. A final decision on review will be made no later than 60 days following the receipt of the written request for review, unless special circumstances require an extension of time for processing, in which case a decision will be made not later than 120 days following the receipt of the request for review. The final decision on review will be furnished in writing and will include the reasons for the decision with a reference to those Plan provisions upon which the final decision is based.

Requests for information concerning the annuity contracts and their terms, conditions and interpretations, claims under those contracts, requests for review of such claims, and service of legal process should be directed in writing to the Fund Sponsor. If a written request is denied, the Fund Sponsor will provide a written denial to the participant within a reasonable period of time. It will include the specific reasons for denial, the provisions of the annuity contracts on which the denial is based, and how to apply for a review of the denied claim. Where appropriate, it will also include a description of any material that is needed to complete or perfect a claim and why such material is necessary. A participant may request in writing a review of a claim denied by the Fund Sponsor and may review pertinent documents and submit issues and comments in writing to the Fund Sponsor. The Fund Sponsor will provide the participant with a written decision regarding the review of a denied claim within 60 days of receipt of the request for review.

As described below, in certain circumstances, you may bring a court action against the Plan to recover benefits due to you. You may only do this if you have first followed the claims procedure described above.

STATEMENT OF ERISA RIGHTS

As a participant in the Plan you are entitled to certain rights and protections under the Employee Retirement Income Security Act of 1974, as amended (ERISA). ERISA provides that all plan participants shall be entitled to:

Receive Information about Your Plan and Benefits

Examine, without charge, at the Plan Administrator’s office and at other specified locations, all documents governing the Plan and a copy of the latest annual report (Form 5500 Series) filed by the Plan with the U.S. Department of Labor and available at the Public Disclosure Room of the Employee Benefits Security Administration.

Obtain, upon written request to the Plan Administrator, copies of all documents governing the operation of the Plan and the latest annual report (Form 5500 Series) and updated SPD. The Plan Administrator may make a reasonable charge for the copies.

Receive a summary of the Plan’s annual financial report. The Plan Administrator is required by law to furnish each participant with a copy of this summary annual report.

Prudent Actions by Plan Fiduciaries

In addition to creating rights for Plan participants, ERISA imposes duties upon the people who are responsible for the operation of the Plan. The people who operate the Plan, called “fiduciaries” of the Plan, have a duty to do so prudently and in the interest of you and other Plan participants and beneficiaries. No one, including your employer or any other person, may fire you or otherwise discriminate against you in any way to prevent you from obtaining a benefit or exercising your rights under ERISA.

Enforce Your Rights

If your claim for a retirement benefit is denied or ignored, in whole or in part, you have a right to know why this was done, to obtain copies of documents relating to the decision without charge, and to appeal any denial, all within certain time schedules.

Under ERISA, there are steps you can take to enforce the above rights. For instance, if you request a copy of plan documents or the latest annual report from the Plan and do not receive them within 30 days, you may file suit in a Federal court. In such a case, the court may require the Plan Administrator to provide the materials and pay you up to $110 a day until you receive the materials, unless the materials were not sent because of reasons beyond the control of the Plan Administrator. If you have a claim for benefits which is denied or ignored, in whole or in part, you may file suit in a state or Federal court. In addition, if you disagree with the Plan’s decision or lack thereof concerning the qualified status of a domestic relations order, you may file suit in Federal court. If it should happen that Plan fiduciaries misuse the Plan’s money, or if you are discriminated against for asserting your rights, you may seek assistance from the U.S. Department of Labor, or you may file suit in a Federal court. The court will decide who should pay court costs and legal fees. If you are successful the court may order the person you have sued to pay these costs and fees. If you lose, the court may order you to pay these costs and fees, for example, if it finds your claim is frivolous.

Assistance with Your Questions

If you have any questions about the Plan, you should contact the Plan Administrator. If you have any questions about this statement or about your rights under ERISA, or if you need assistance in obtaining documents from the Plan Administrator, you should contact the nearest office of the Employee Benefits Security Administration, U.S. Department of Labor, listed in your telephone directory or the Division of Technical Assistance and Inquiries, Employee Benefits Security Administration, U.S. Department of Labor, 200 Constitution Avenue, N.W., Washington, D.C. 20210. You may also obtain certain publications about your rights and responsibilities under ERISA by calling the publication hotline of the Employee Benefits Security Administration.

Pension Benefit Guaranty Corporation

The Pension Benefit Guaranty Corporation (PBGC) does not insure benefits under the Plan if the Plan terminates. Generally, the PBGC guarantees benefits under defined benefit plans but not under defined contribution plans such as the Plan.

PLAN NAME: Vassar College 403(b) Retirement Plan

PLAN SPONSOR &

PLAN ADMINISTRATOR: Vassar College

124 Raymond Avenue

Poughkeepsie, NY 12604

Tel: 845-437-7000

PLAN ADMINISTRATOR’S

REPRESENTATIVE: Manager, Benefits Programs

Benefits Office, Vassar College

Box 718

Poughkeepsie, NY 12604

Tel: 845-437-5850

E-mail: [email protected]

TYPE OF PLAN: Defined contribution 403(b) plan

PLAN NUMBER: 002

EMPLOYER IDENTIFICATION

NUMBER: 14-1338587

PLAN YEAR: January 1 to December 31

FUND SPONSOR: Fidelity Investments

82 Devonshire Street

Boston, MA 02109

1-800-343-0860

TIAA-CREF

730 Third Avenue

New York, NY 10017

1-800-842-2776

LEGAL PROCESS: Service of legal process may be made upon the Plan Administrator.

A0048273 (Faculty and Administrator - 121610)

1 Effective July 1, 2011, the contribution rate for eligible Faculty employees who are aged 40 or older will decrease from 14% to 12%.

Tags: 403(b) retirement, contribution 403(b), vassar, description, retirement, 403(b), college, summary

- TRABAJO EFECTUADO POR JUAN LUIS ESPIGARES DE LA HIGUERA

- SCT CULTIUS CEL·LULARS PLANTILLES SCTCC FITXA D’USUARI DEL SCTCC

- ACTA DE CONSTITUCIÓN DE LA JUNTA DEL PERSONAL DOCENTE

- IZJAVA O ETICI OBJAVE I ZLOPORABAMA U POSTUPKU OBJAVE

- COLEGIO OFICIAL DE APAREJADORES Y ARQUITECTOS TÉCNICOS DE PALENCIA

- LENGUA COMPRENSIÓN LECTORA 1 NOMBRE Y APELLIDOS CURSO

- IZBOR NOVEJŠE LITERATURE BOLEZNI SRCA IN OŽILJA KRVNEGA TLAKA

- IN THE STATE COMMISSION DELHI (CONSTITUTED US 9 CLAUSE

- «СОГЛАСОВАНО» «УТВЕРЖДАЮ» ЗАМ ГЛАВЫ УПРАВЫ РУКОВОДИТЕЛЬ РАЙОНА ИВАНОВСКОЕ ГБУ

- SEISMIC PROJECT REQUEST FACT SHEET APPENDIX G SEISMIC PROJECT

- KARTA EWIDENCYJNA NIERUCHOMOŚCI ZAŁĄCZNIK NR 1 DO ANKIETY NAZWA

- INSCRIPCIONES CONCURSO DE ANTEPROYECTOS PARA LA CONSTRUCCIÓN DE EDIFICIO

- ¿CUÁL DE ESTOS NAVEGADORES USA? INTERNET EXPLORER (60) 1

- 1 ANEXOS ANEXO I PRESENTACIÓN DE LA MANIFESTACIÓN DE

- RICHIESTA AMMISSIONI DAL MENU PRINCIPALE SCEGLIERE LOPZIONE 1 INSERIMENTO

- BLANCO GARCÍA SANDRA 4ºC BLANCO GONZÁLEZ NOA 4ºB CALVO

- FOODBORNE DISEASE WHAT ARE FOODBORNE DISEASES? THE TERM ‘FOODBORNE

- SEKRETESSAVTAL DETTA SEKRETESSAVTAL (”AVTALET”) HAR INGÅTTS MELLAN 1 LUNDS

- PLANNING PROVISOIRE (DU 29 AOÛT 2006) UN ACCUEIL DES

- PREMIO EMPRESARIOS AGRUPADOS “DESARROLLO DE MODELOS YO LIBRERÍAS EN

- EUROSCOLA LIST OF PARTICIPANTS AND AUTHORISATION FOR WEBSTREAMING

- CANTINE SCOLAIRE 7 AVENUE 2ÈME DI INDIAN HEAD 50680

- 28 EL MODELO ECONÓMICO COLONIAL Y SUS CONTRADICCIONES FERNANDO

- EB23ES CUNHA RIVARA EXAMEN DE DIAGNÓSTICO – 9º CURSO

- EDIFICIO ADMINISTRATIVO SAN CAETANO SN 15781 SANTIAGO DE COMPOSTELA

- 2 NOMBRAMIENTO DEL PRÓXIMO DIRECTOR GENERAL COMUNICACIÓN

- THE EGYPTIAN AMERICAN INTERNATIONAL SCHOOL ENGLISH LITERATURE GRADE

- FORMULAR DE CERERE MASTER CLASS MOLDOVA 2014 ECONOMIA VERDE

- ŠTEVILKA DATUM 02 06 2015 Z A P I

- 621 SECTION 6 – STANDARD FORMS OF CONTRACT –

CLAUSULA PARA AGENTE DE CARGA INTERNACIONAL YO FREIGHT FORWARDER

ČINNOST PŘI OZNÁMENÍ HROZBY POUŽITÍ BOMBY ZÁKLADNÍ ZÁSADY POSTUPŮ

PENGELOLAAN SARANA DAN PRASARANA UNIVERSITAS PENDIDIKAN GANESHA KODE DOKUMEN

PENGELOLAAN SARANA DAN PRASARANA UNIVERSITAS PENDIDIKAN GANESHA KODE DOKUMENAÇÕES EXCELENTÍSSIMO SENHOR DOUTOR JUIZ FEDERAL DA VARA

NOTICE OF COMMUNITY SERVICE ORDER SECTION 8 CRIMES

LIETUVOS ENERGETIKOS INSTITUTO AKADEMINĖS ETIKOS KODEKSAS 1 BENDROSIOS

NÁVOD NA POUŽITÍ SPORT TESTER BION A300 PŘED POUŽITÍM

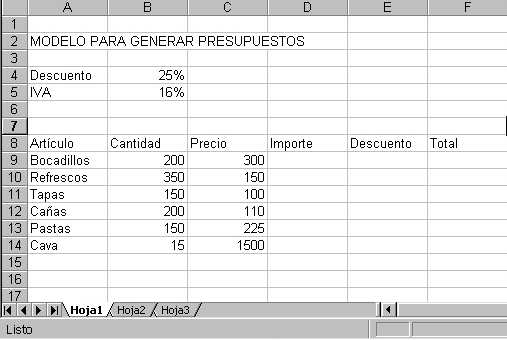

NÁVOD NA POUŽITÍ SPORT TESTER BION A300 PŘED POUŽITÍM REFERENCIAS RELATIVAS O ABSOLUTAS CUANDO COPIAMOS FÓRMULAS ES NECESARIO

REFERENCIAS RELATIVAS O ABSOLUTAS CUANDO COPIAMOS FÓRMULAS ES NECESARIO10 LA POLITICA EN LA DOCTRINA SOCIAL DE LA

UNIVERSIDAD NACIONAL DE SALTA FCULTAD DE HUMANIDADES CÁTEDRA DE

DISTRICT COURT OF QUEENSLAND REGISTRY APPEAL NUMBER [FIRST] APPELLANT

İLETIŞIM BILGILERI AD SOYAD CAN PELİT ADRES ACARLAR SITESI

M211 PART III SUBPART V CHAPTER 4 SECTION C

KOPRIVNICA 07062010 G HRVATSKA AGENCIJA ZA NADZOR FINANCIJSKIH USLUGA

PSKO96122720166 PAN JAROSŁAW STRUGAREK 62600 WRZĄCA WIELKA 45 NA

2 PANEVĖŽIO RAJONO RAGUVOS KULTŪROS CENTRAS FINANSINIŲ ATASKAITŲ AIŠKINAMASIS

MINISTERIO DE TRABAJO SANIDAD Y SEGURIDAD SOCIAL (BOE N

TRUE LIVESPLENA 2 FOR IMMEDIATE RELEASE CONTACTS CYNTHIA

PSYCHOLOGY RESEARCHER LISA SCOTT RIGHT WITH A MOTHER AND

UPUTE PONUDITELJIMA 1 NARUČITELJ URIHO USTANOVA ZA PROFESIONALNU REHABILITACIJU