ANSWER KEY FOR PROBLEM SET 3 ANALYTICAL PROBLEMS 1

ANSWER THE FOLLOWING QUESTIONS IN SUPPLIED “ANSWER SHEETS”DEATH DYING & BEREAVEMENT ANSWERS (16) 1

ENGAGING IN INDUSTRY PROJECTS QUESTIONNAIRE PLEASE ANSWER

QUESTION & ANSWER (Q&A) MATRIX ON IMPLEMENTATION OF

VIDEO TRAINING PRESSURE ULCER PREVENTION ANSWERS (15)

(C) 2011 LANTERNFISH ESL AT WWWBOGGLESWORLDESLCOM ANSWER KEY WHAT

Answer Key for Problem Set 3

Analytical Problems

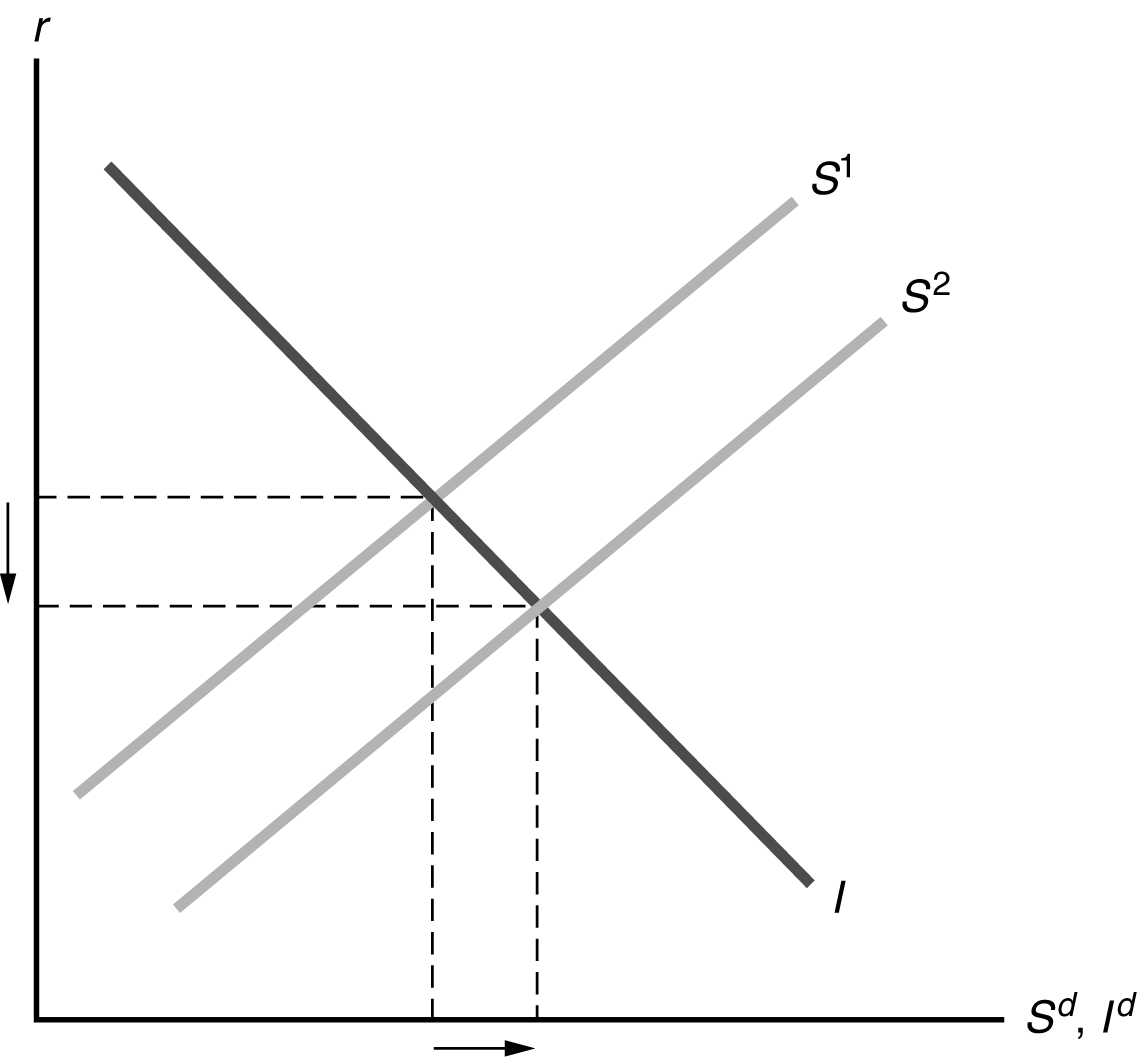

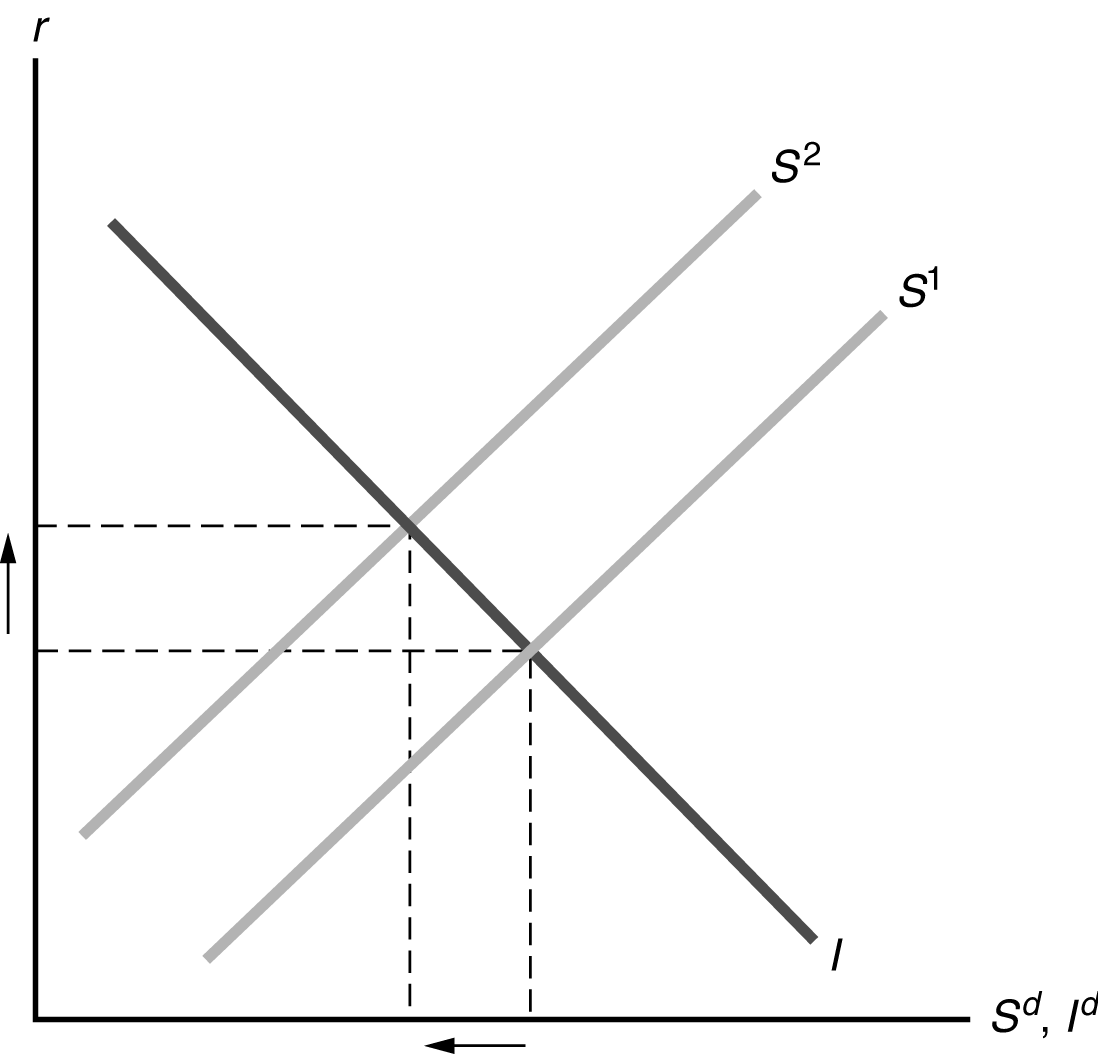

1. (a) As Figure 4.5 shows, the shift to the right in the saving curve from S1 to S2 causes saving and investment to increase and the real interest rate to decrease.

Figure 4.5

(b) This is really just a transfer from the general population to veterans. The effect on saving depends on whether the marginal propensity to consume (MPC) of veterans differs from that of the general population. If there is no difference in MPCs, there will be no shift of the saving curve; neither investment nor the real interest rate is affected. If the MPC of veterans is higher than the MPC of the general population, then desired national saving declines and the saving curve shifts to the left; the real interest rate rises and investment declines. If the MPC of veterans is lower than that of the general population, the saving curve shifts to the right; the real interest rate declines and investment rises.

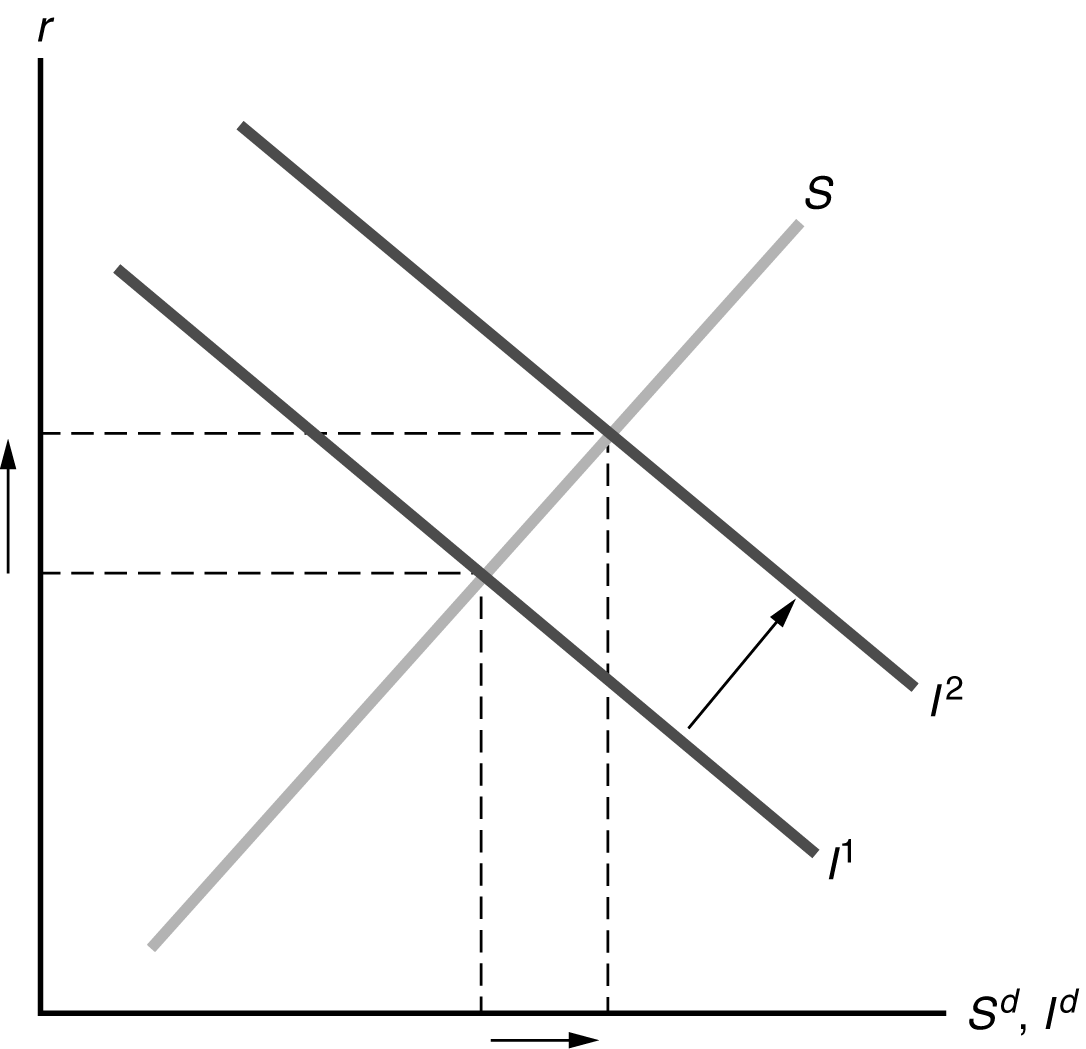

(c) The investment tax credit encourages investment, shifting the investment curve from I1 to I2 in Figure 4.6. Saving and investment increase, as does the real interest rate.

Figure 4.6

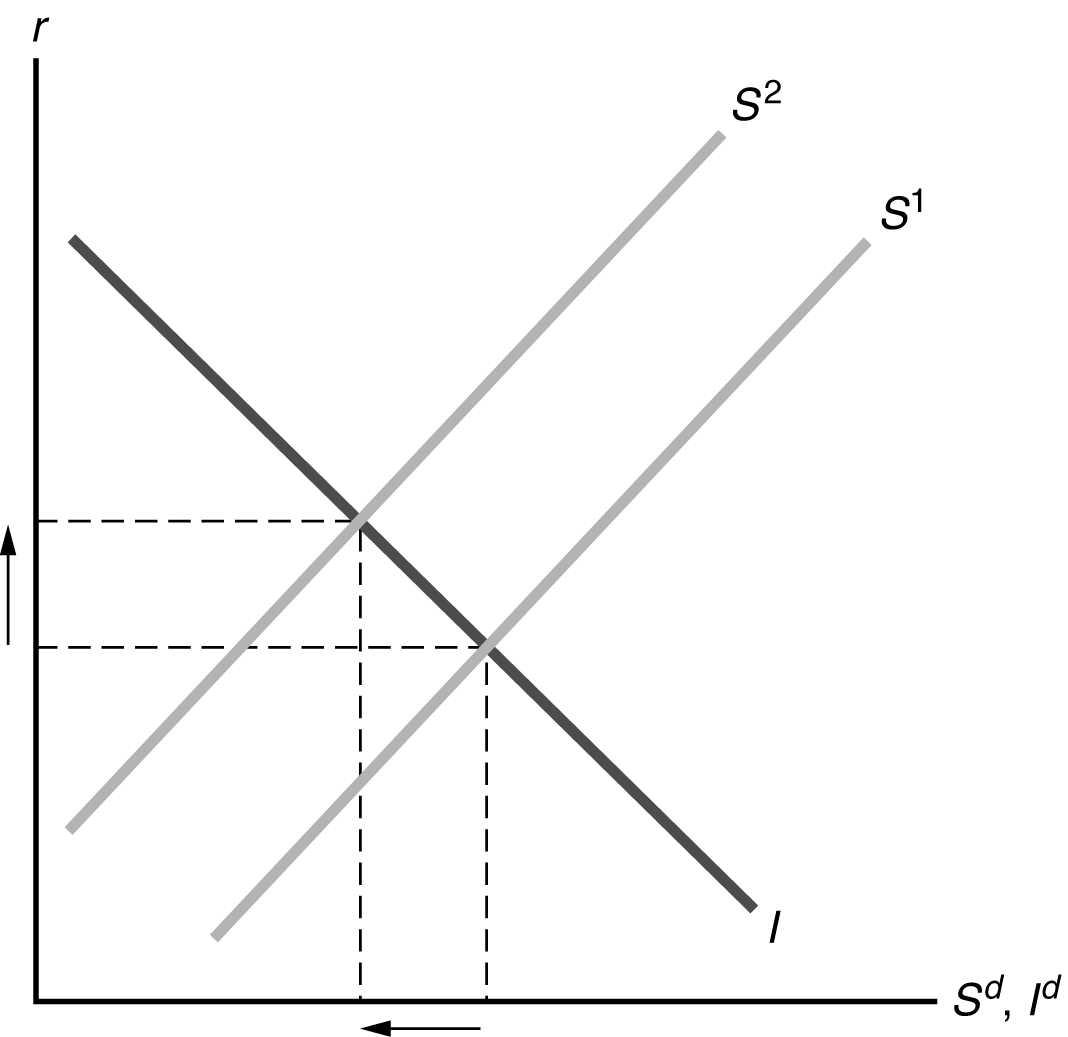

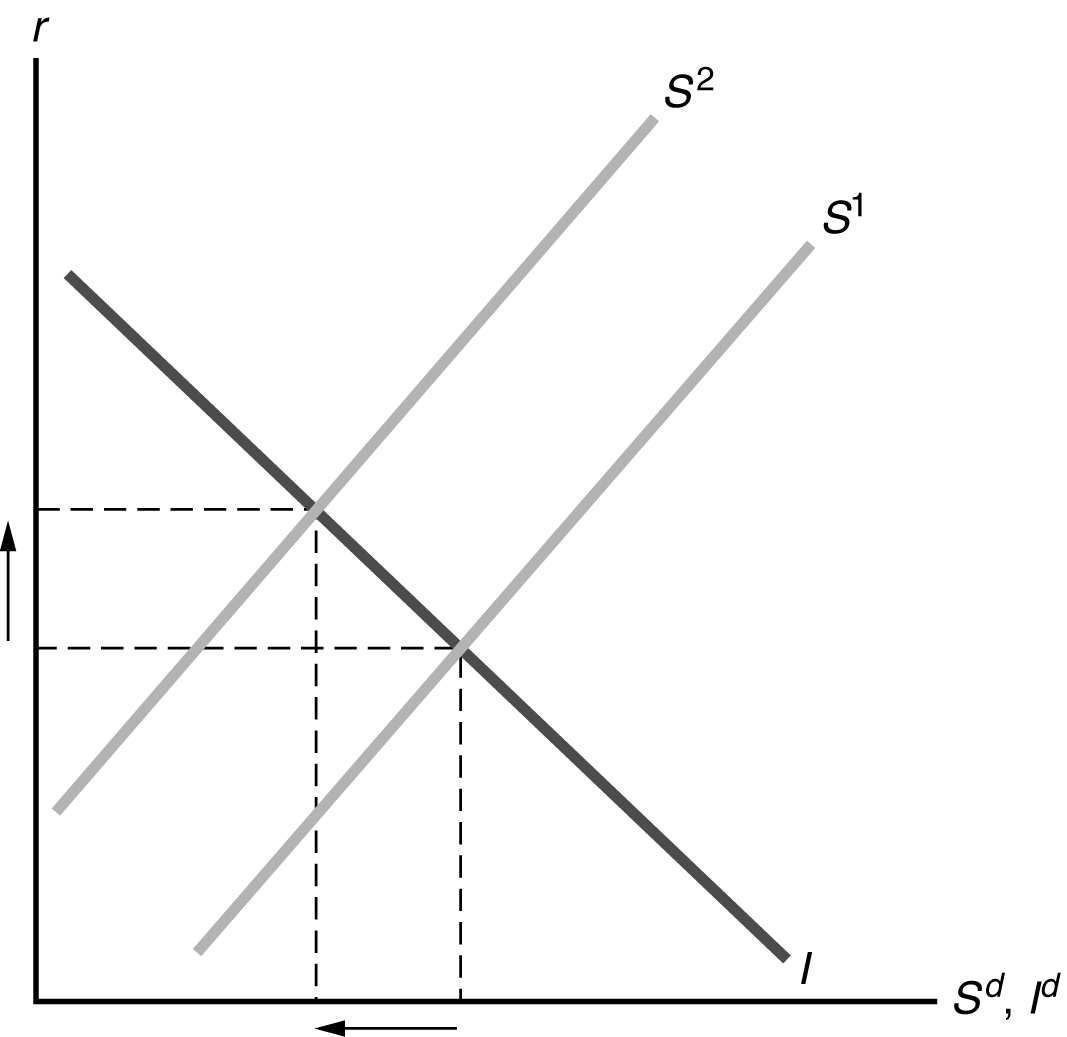

(d) The increase in expected future income decreases current desired saving, as people increase desired consumption immediately. The rise of the future marginal productivity of capital shifts the investment curve to the right. The result, as shown in Figure 4.7, is that the real interest rate rises, with ambiguous effects on saving and investment.

Figure 4.7

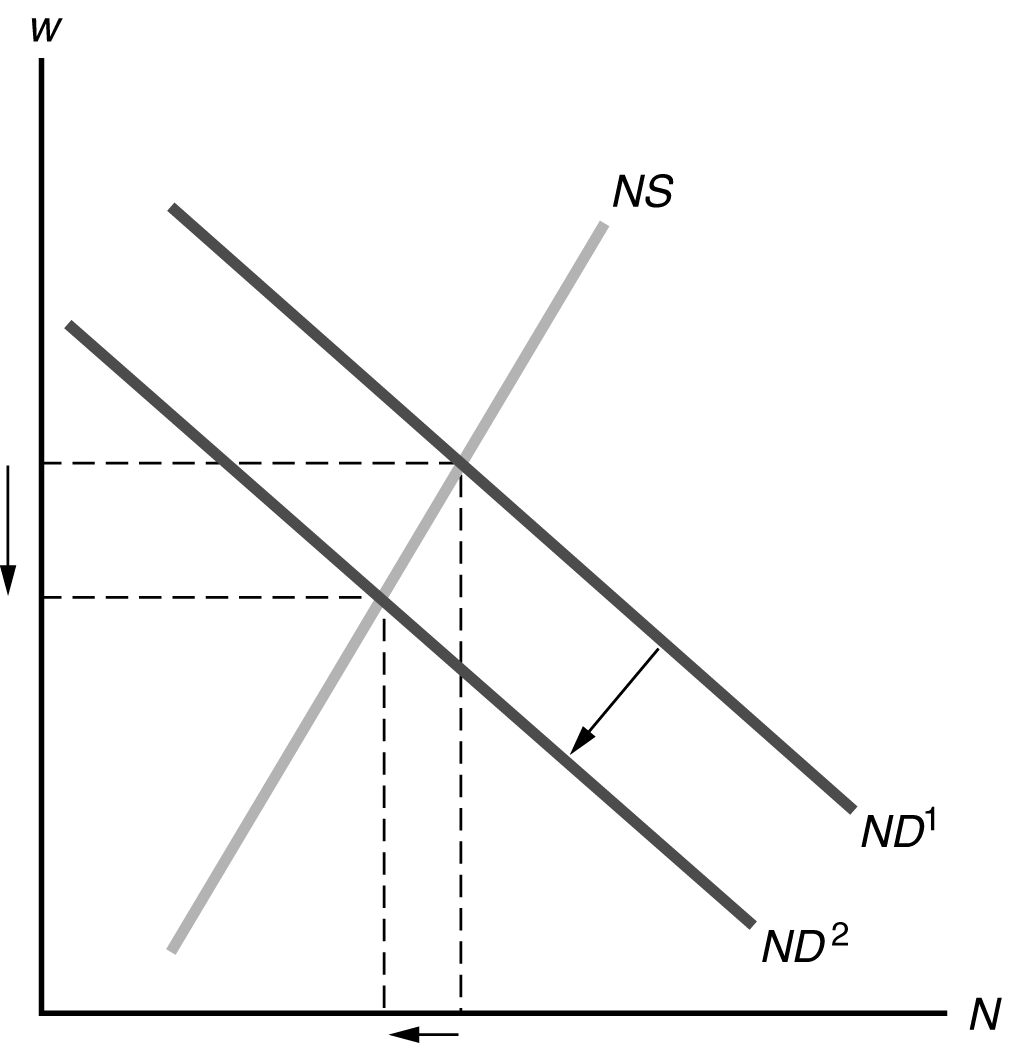

2. (a) With a lower capital stock, the marginal product of labor is reduced, so the labor demand curve shifts to the left from ND1 to ND2 in Figure 4.8. Then the new equilibrium point is one with lower employment and a lower real wage. With lower employment and a lower capital stock, full-employment output will be lower.

Figure 4.8

(b) Because the capital stock is lower, the marginal product of capital will be higher, so desired investment will increase.

(c) Since current output declines, desired saving declines, because people do not want to reduce their consumption. On the other hand, since future output is also lower, people desire to save more today to make up for the loss of future income.

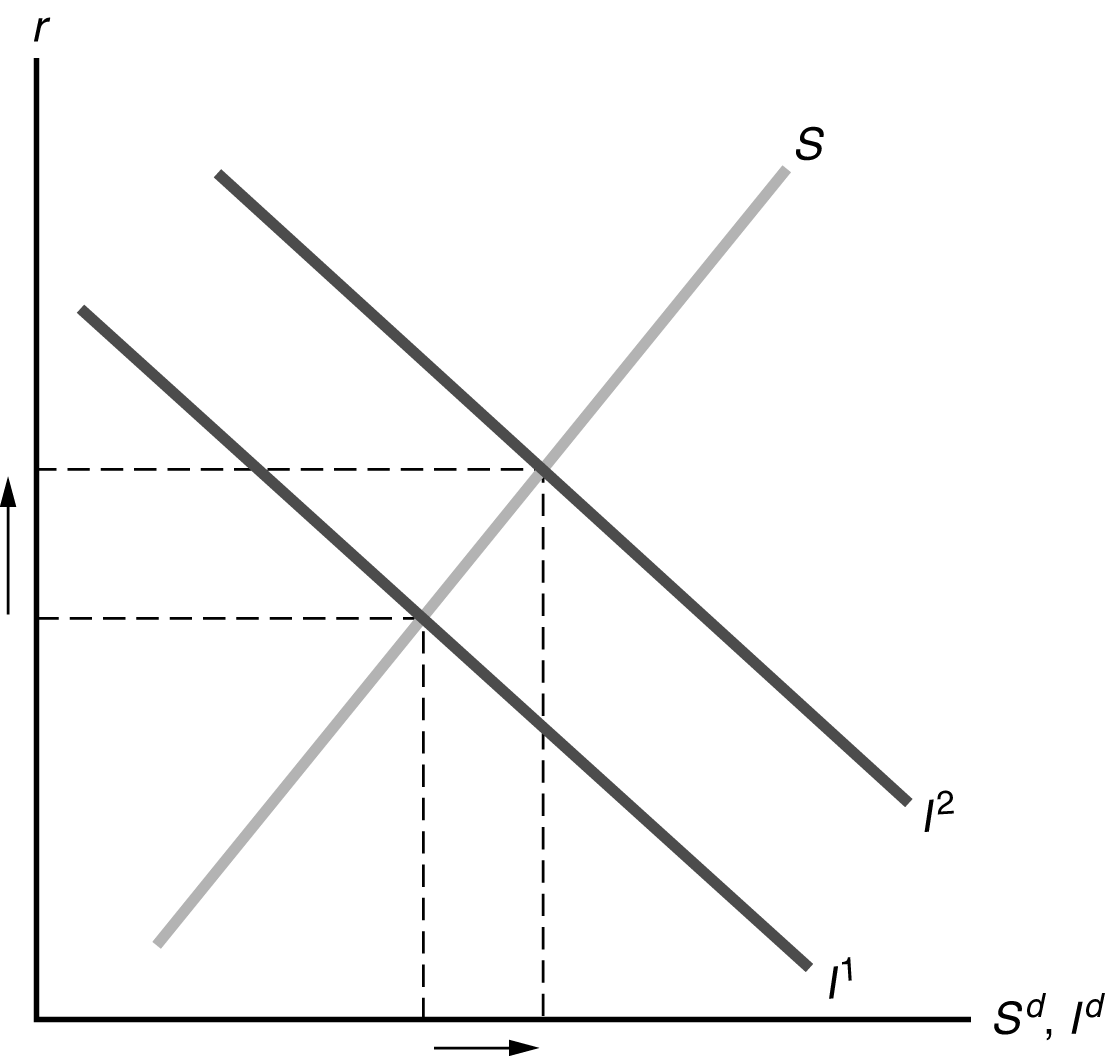

(d) The increase in desired investment shows up as a shift to the right in the Id curve, from I1 to I2 in Figure 4.9. Then the new equilibrium (assuming no change in desired saving) is at a higher level of investment and a higher real interest rate.

Figure 4.9

3. (a) The temporary increase in the price of oil reduces the marginal product of labor, causing the labor demand curve to shift to the left from ND1 to ND2 in Figure 4.10. At equilibrium, there is a reduced real wage and lower employment.

Figure 4.10

The productivity shock results in a reduction of output. Because the shock is temporary, the only effect on desired saving or investment is due to the reduction in current output, causing desired national saving to fall. This shifts the saving curve to the left, raising the real interest rate and reducing the level of desired investment, as well as desired national saving, as shown in Figure 4.11.

Figure 4.11

(b) The permanent increase in the price of oil reduces the marginal product of labor, causing the labor demand curve to shift to the left, again as in Figure 4.10. (Also, the decline in future income means the labor-supply curve will shift to the right; but we’ll assume that this shift is less than the shift to the left of the labor-demand curve.) At equilibrium, there is a reduced real wage and lower employment.

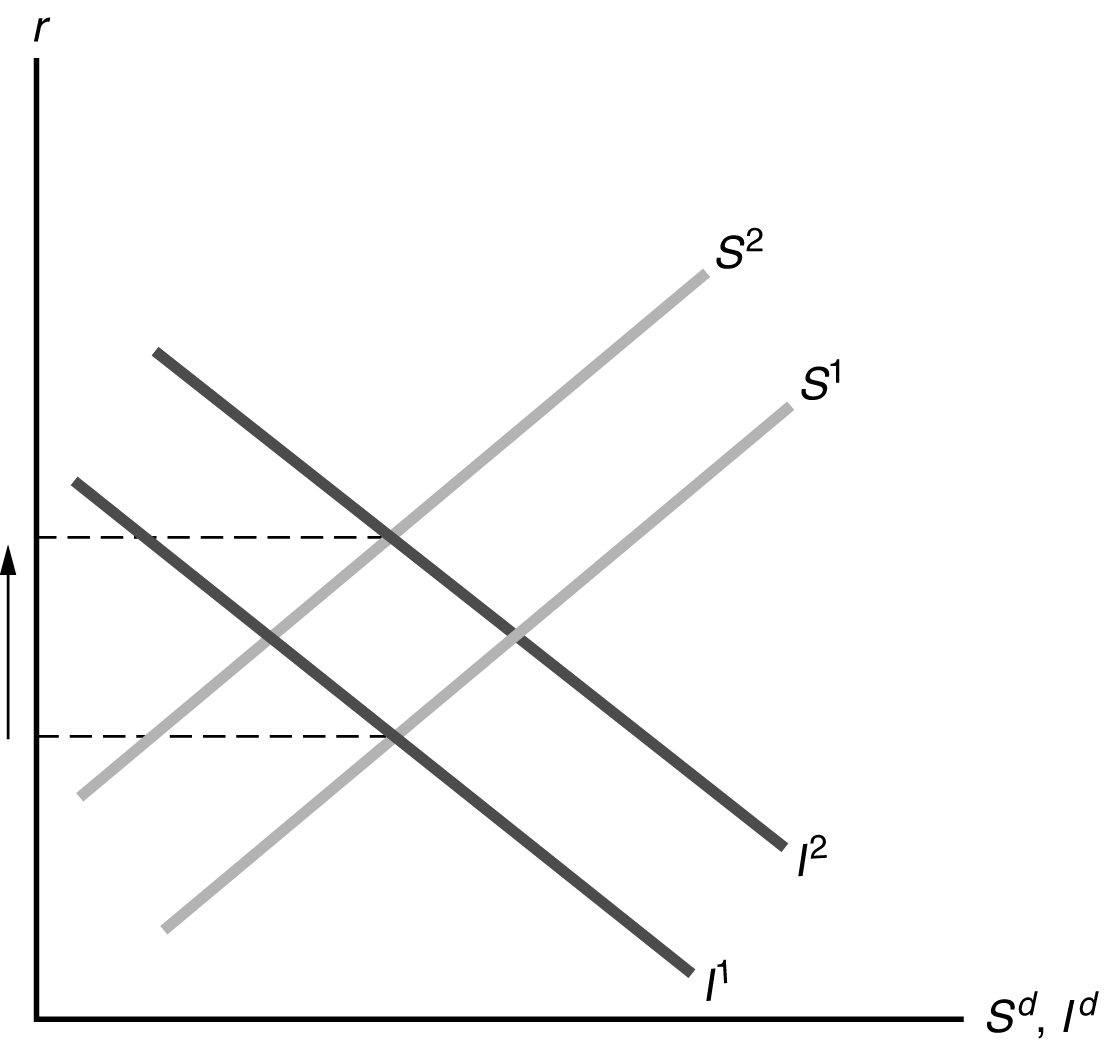

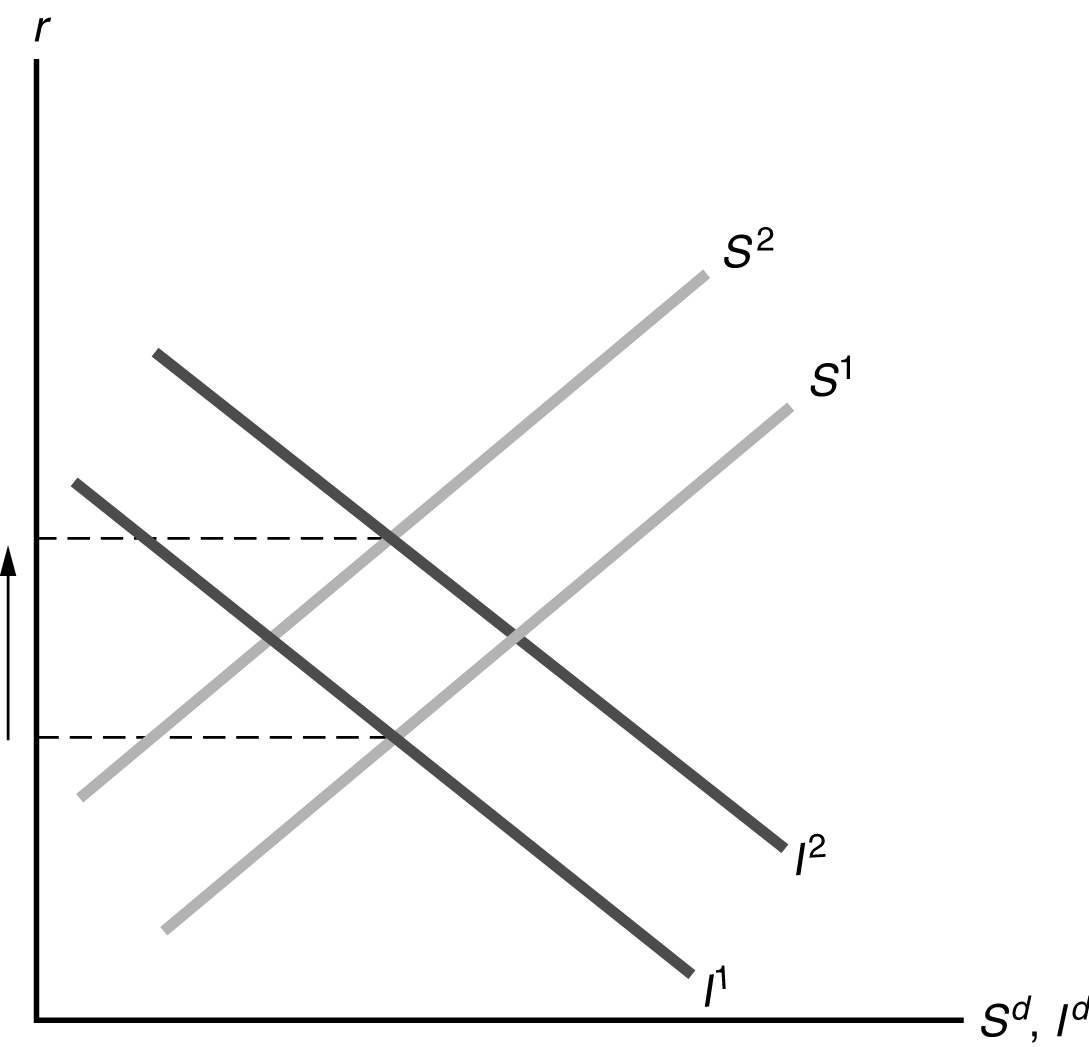

The productivity shock results in a reduction of current output. Because the shock is permanent, it reduces future output as well, and reduces the future marginal product of capital. The desired investment curve shifts to the left, from I1 to I2 in Figure 4.12, because the future marginal product of capital is lower. The effect on desired saving is ambiguous—the reduction in current income reduces desired saving, but the reduction in expected future income increases desired saving. Let’s assume that the former effect outweighs the latter, so that the desired saving curve shifts to the left from S1 to S2. Then national saving and investment both decline. Again, the effect on the real interest rate is ambiguous. (Alternatively, if the effects on desired saving of the

reductions in current income and future income offset each other exactly, the desired saving curve does not shift. In this case, the leftward shift of the investment curve along an unchanged saving curve reduces the real interest rate, saving, and investment.)

Figure 4.12

4. A temporary increase in government spending reduces national saving. Whether the spending is financed by current taxes or by borrowing (and raising future taxes), consumption falls, but not by the full amount of the spending. Since S Y – Cd – G, national saving declines. This is shown in Figure 4.13 as a shift to the left in the saving curve. The real interest rate must increase to get S I, so I declines as well. It makes no difference whether the temporary increase in spending is funded by taxes or by borrowing.

Figure 4.13

In the case of infrastructure spending, MPKf rises, so investment increases. Saving shifts from S1 to S2 and investment shifts from I1 to I2 in Figure 4.14. With upward shifts in both saving and investment, the new equilibrium is one with a higher real interest rate. However, saving and investment at the new equilibrium may be higher or lower. The effect on consumption is unclear as well. The higher real interest rate reduces consumption, but future income is higher, which increases consumption. If investment actually rises, then the increase in government spending causes private investment to be “crowded in” rather than “crowded out.” In this case consumption is crowded out.

Figure 4.14

5. When there is a temporary increase in government spending, consumers foresee future taxes. As a result, consumption declines, both currently and in the future. Thus current consumption does not fall by as much as the increase in G, so national saving (Sd Y – Cd – G) declines at the initial real interest rate, and the saving curve shifts to the left from S1 to S2, as shown in Figure 4.15. Thus the real interest rate increases and consumption and investment both fall.

Figure 4.15

When there is a permanent increase in government spending, consumers foresee future taxes as well, with both current and future consumption declining. But if there is an equal increase in current and future government spending, and consumers try to smooth consumption, they will reduce their current and future consumption by about the same amount, and that amount will be about the same amount as the increase in government spending. So the saving curve in the saving-investment diagram does not shift, and there is no change in the real interest rate.

Since the saving curve shifts upward more in the case of a temporary increase in government spending, the real interest rate is higher, so investment declines by more. However, consumption falls by more in the case of a permanent increase in government spending.

(το Answer key Ετοιμάστηκε από Τους Καθηγητές του Φροντιστηρίου

(THE ANSWERS ARE AT THE END OF THE DOCUMENT)

04%20Answer%20Key

Tags: analytical problems, analytical, answer, problem, problems

- ARBEITSHILFE ZUR QUALITÄTSSICHERUNG ARBEITSHILFE DER BUNDESAPOTHEKERKAMMER ZUR QUALITÄTSSICHERUNG

- NA TEMELJU ČLANKA 66 ZAKONA O POLJOPRIVREDI („NARODNE NOVINE“

- POWERPLUSWATERMARKOBJECT3 POSITION TITLE CLINICALCOUNSELLINGFORENSIC PSYCHOLOGIST CLINICALCOUNSELLINGFORENSIC PSYCHOLOGIST (REGISTRAR) CLASSIFICATION

- DOCUMENTO PROGRAMMATICO SULLA SICUREZZA AI SENSI DEL DLGS 19603

- DECLARACIÓN DE RÍO SOBRE EL MEDIO AMBIENTE Y EL

- AGENCIA PROVINCIAL DE LLEIDA MAYCA CRUZ TR MATERIALES NO

- CÓDIGO CIVIL LIBRO SEGUNDO DE LOS BIENES DE LA

- COMENTARIOS A LOS RECORTES A LA LEY DE DEPENDENCIA

- EXCMA DIPUTACION PROVINCIAL AREA DE HACIENDA RRHH Y RINTERIOR

- I CONFERÊNCIA NACIONAL DOS DIREITOS DA PESSOA COM DEFICIÊNCIA

- PATIENT FOCUS GROUP REPORT FOR PERIOD APRIL 2016

- CARROLL COUNTY MEMORIAL HOSPITAL CORPORATE COMPLIANCE & POLICY SECTIONNO

- COMMUNITY RIGHT TO BID EXPRESSION OF INTEREST FORM

- AYLESHAM MEDICAL PRACTICE PRIVACY NOTICE DIRECT CARE

- CONTRATO DE TRANSFERENCIA TEMPORAL DE DATOS PERSONALES1 ENTRE LOS

- ODELL RECREATION SPORTS ASSOCIATION ARTICLE I ORGANIZATION SECTION 1

- PRIMORSKOGORANSKA ŽUPANIJA IZVJEŠĆE SA SLUŽBENOG PUTA U NORDIJSKI CENTAR

- Ubezpieczenie Eksperymentów Medycznych Zgłoszonych i Zaakceptowanych Przez Komisję Bioetyczną

- LABORATORIOS SERVIER A TRAVÉS DE SU PROYECTO CARDIOIMPULSO Y

- AQAR 201516 THE ANNUAL QUALITY ASSURANCE REPORT (AQAR) FOR

- 13 EYEWITNESS IDENTIFICATION BRIDGTON POLICE DEPARTMENT POLICY SUBJECT BRIDGTON

- CUMHURİYET ÜNİVERSİTESİ İMRANLI MESLEK YÜKSEKOKULU KAMU HİZMET STANDARTLARI TABLOSU

- SZABLON – POROZUMIENIE O WSPÓŁPRACY MIĘDZY …………………………………………… (PEŁNA

- CROW HILL PRINCETON AND WESTMINSTER 111402FINALFINAL LANDOWNER MASSACHUSETTS DEPT

- THE CONVERSION OF UBUNTU – AN AFRICAN VISION OF

- OŚWIADCZENIE O WYRAŻENIU ZGODY NA PRZETWARZANIE DANYCH OSOBOWYCH CZŁONKA

- 1 DE 1 TÉRMINOS DE REFERENCIA PLAN INMEDIATO DE

- SEMINARIO MUJER Y MIGRACIÓN EN LA REGIÓN DE LA

- FORO DE JUVENTUD JÓVENES EN PORTADA MEDIOS DE COMUNICACIÓN

- MOMENTUM MOMENTUM MASS IN MOTION P MV (KGMS) VECTOR

11 DRUK NR 4279A SEJM RZECZYPOSPOLITEJ POLSKIEJ VI KADENCJA

11 DRUK NR 4279A SEJM RZECZYPOSPOLITEJ POLSKIEJ VI KADENCJA ÁLGEBRA 2N ESO CURS 20092010 DEURES NADAL 1 REPRESENTA

ÁLGEBRA 2N ESO CURS 20092010 DEURES NADAL 1 REPRESENTADATOS PERSONALES NOMBRE RICARDO GUZMÁN OLACHEA LUGAR Y

SEPTIEMBRE 2006 CONDICIONES DE VIDA DE LAS PERSONAS

GRAD SUBOTICA MESNA ZAJEDNICA „ŽELJEZNIČKO NASELJE” SKUPŠTINA MESNE ZAJEDNICE

INDEXES INDEX LITERARY INDEX GALE’S LITERARY INDEX IS A

PACIFIC SOUTH WESTERN ADVOCATES 4402B SHELBOURNE ST VICTORIA BC

SUMMARY OF REAL ESTATE ACQUISITION PROCESS FOR NON GRANT

CREDIT PROFESSIONALS INTERNATIONAL POST CONFERENCE BOARD MEETING MENGER HOTEL

CREDIT PROFESSIONALS INTERNATIONAL POST CONFERENCE BOARD MEETING MENGER HOTELJANUAR 2013 FEBRUAR 2013 MARS 2013 UKE MA TI

BOYLE’S LAW P1 X V1 P2 X V2

СЛУЖБА В ФСБ ЭТО ВОЗМОЖНО! В СЛУЖБУ В Г

SEPTIC ASSOCIATED ENCEPHALOPATHY EVERYTHING STARTS AT A MICROLEVEL TAREK

THE PRESENT DAY GEORGE WASHINGTON CARVER MUSEUM AND CULTURAL

NAME DES EMPFÄNGERS STRASSE PLZ ORT 22 JANUAR

NAME DES EMPFÄNGERS STRASSE PLZ ORT 22 JANUAR DATA WPŁYNIĘCIA WNIOSKU1 …………………………… NUMER WNIOSKU …………………… WNIOSEK O

DATA WPŁYNIĘCIA WNIOSKU1 …………………………… NUMER WNIOSKU …………………… WNIOSEK OLAS REGLAS DEL JUEGO RIESGOLANDIA ES UN JUEGO DIDÁCTICO

HIGHER NATIONAL UNIT SPECIFICATION GENERAL INFORMATION UNIT TITLE SEE

HIGHER NATIONAL UNIT SPECIFICATION GENERAL INFORMATION UNIT TITLE SEE OBRAZAC C2 – OBRAZAC OPISNOG IZVJEŠTAJA PROJEKTA MINISTARSTVO REGIONALNOGA

OBRAZAC C2 – OBRAZAC OPISNOG IZVJEŠTAJA PROJEKTA MINISTARSTVO REGIONALNOGAIII21 EL SUBSTANTIU LES DECLINACIONS CASOS I FUNCIONS (2)