EFFECTIVE REMEDIES? REMEDIES IN COMPETITION CASES – A HOT

8 ASSIGNMENT AGREEMENT THIS AGREEMENT IS EFFECTIVEBARRIERS TO EFFECTIVE CLIMATE CHANGE ADAPTATION PRODUCTIVITY COMMISSION

GUIDELINES ON CHAIRING MEETINGS EFFECTIVELY EFFECTIVE CHAIRING

I NSTITUTIONAL EFFECTIVENESS COMMITTEE MEMBERS JEMMA BLAKEJUDD

SUBJECT INTENSIVE LIVESTOCK OPERATIONS EFFECTIVE 12312007 REVISED

(EFFECTIVE WITH THE FRESHMAN CLASS ENTERING 2013 UPDATED

Effective Remedies?

Remedies in competition cases – a hot topic

The effectiveness of remedies in competition cases is currently the focus of several studies and initiatives. On 22 May 2007, the OECD published a paper setting out the proceedings of a policy roundtable, held by the OECD Competition Committee in June 2006, on remedies and sanctions in abuse of dominance cases1. The Competition Commission published a report on past merger remedies in January 20072. The European Commission published its own report on merger remedies in October 20053 and is currently conducting a consultation on draft revised guidelines on remedies in merger control cases4.

While the emphasis to date has been on ex post assessment of merger remedies, the focus is shifting to other competition cases. Whilst there has been some assessment of the benefits of decisions by competition authorities in financial and budget terms5, assessment of the effectiveness of remedies from a competition law and economics perspective has perhaps been rather more piecemeal to date.

If the purpose of competition policy is to make markets work well for consumers, some systematic assessment of how effective remedies have been in contributing to consumer welfare would appear to be a necessary part of the process. Such ex post review would be likely to inform the choice of ex ante case prioritisation in situations where competition authorities have discretion.

Alternatively, to the extent compensation represents the appropriate remedy, now that follow-on and stand alone damages actions are being facilitated, perhaps the competition authorities can increasingly limit intervention to bringing infringements to an end and leave remedies to the courts.

Effectiveness of remedies – some observations so far

In the merger context, the competition objective of remedies is to maintain effective competition by preventing the creation or strengthening of a dominant market position. In anti-trust cases, the aim of remedies is to restore competition in the relevant market. The Article 81/82 prohibition-based system is designed to eliminate particular practices or agreements which have developed in a particular market. Behavioural or structural remedies can be imposed which are proportionate to the infringement committed and necessary to bring the infringement effectively to an end.6

Some studies on effectiveness of remedies are briefly considered below.

The Federal Trade Commission published findings concerning divestiture remedies in 19997. Divestiture packages must include all assets necessary for a purchaser to compete; divestitures of ongoing stand-alone businesses tend to be more successful than divestitures of selected assets; divesting parties tend to look for purchasers that will be weak competitors.

When considering the effectiveness of the types of remedies used in merger cases, the European Commission study of October 2005 found that, overall, joint venture remedies8 were the most effective type of remedy while the effectiveness of access remedies9 was considered to be weak.10

In its January 2007 report, the Competition Commission considered the effectiveness of remedies in the merger context. Ongoing monitoring, employee education and continuing awareness of the need for compliance were identified as important factors. Where a remedy depends on action by a third party, this creates a risk that the remedy will not be effective.11 To ensure parties give effect to a proposed remedy, the possibility that it be enforced by order, or, that another more intrusive remedy might be imposed, are useful. In relation to divestitures, it is important to indicate clearly those elements that should be included as part of the remedy.12 Behavioural remedies are more complicated than structural remedies: they require more work (especially in relation to design), they must remain relevant over time and require ongoing monitoring.13

In abuse of dominance cases, the OECD Roundtable drew a number of conclusions. Identifying effective remedies in such cases has generally proven to be difficult. It is, therefore, helpful to spend time early in the investigative process defining the remedial objectives, as well as having a thorough investigation of the relevant industry and how it is likely to evolve.14 Agencies should also implement a systematic process for evaluating the effectiveness of past remedies as this will further enable them to design more effective remedies.15

Structural remedies, which require firms to sever links from assets they hold, have the virtue of being able to eliminate market power rapidly while creating or invigorating competitors. They may also require less oversight than other remedies do. On the other hand, some structural remedies may initially be more disruptive to the business of the committing parties than other remedies are, and they sometimes create immediate inefficiencies. In addition, history has shown that structural remedies are not always easy to administer.16

Behavioural remedies, which oblige a company either to do something or to stop doing something, can be tailored to fit individual cases and market circumstances. Overall, in this context they are considered less controversial than divestitures and have been applied far more frequently in abuse of dominance cases. Nonetheless, behavioural remedies are sometimes criticised because they do not attack concentration and market power directly. They also tend to require ongoing, and occasionally extensive, oversight and intervention by courts and agencies. Furthermore, behavioural remedies are more susceptible to strategic neutralisation, minimisation, or evasion by the committing parties than other measures are.17

In market investigations, if the Competition Commission concludes that there are one or more features of a market which are adversely affecting competition then it may seek appropriate remedies to address them. These can be structural or behavioural. Paul Geroski observed: "Market inquiries have as their goal the task of ensuring that markets that are not very competitive will be more so in the future than they have been in the past. ... we need to spend more time thinking about remedies. This is, for us, a new responsibility, and it turns out that there has been little systematic examination of the appropriateness and effectiveness of different types of remedies in different circumstances."18

Remedies in some recent cases are briefly considered below.

The Competition Commission 2000 inquiry into Supermarkets19 concluded that several practices in respect of suppliers to supermarkets with market power operated against the public interest. The remedy was the Supermarkets Code of Practice. This has long been criticised as ineffective. Could another remedy have achieved a better result? By contrast, the adjudicator system for TV advertising pricing as part of the Carlton/Granada merger clearance has widely been regarded as very effective. Are there learnings from these two cases?

The Microsoft case20 of March 2004 concerned an infringement of Article 82. Microsoft was required to offer a version of its Windows OS without Windows Media Player to PC manufacturers (or when selling directly to end users). Was this remedy effective?

As part of its 2005 settlement of its Coca-Cola investigation21, the European Commission agreed a range of commitments, including: preventing Coca-Cola from entering into exclusivity arrangements with shops and pubs, offering customers target or growth rebates or forcing them to take less popular products with its stronger brands; and enabling use of 20% of space in Coca-Cola's coolers for other products. Competition Commissioner Neelie Kroes commented: "This decision will benefit consumers by imposing competition in the markets for carbonated soft drinks in Europe. Thanks to the Commission's decision, consumers will be able to choose from a larger range of fizzy drinks at competitive prices."22 Discuss.

As part of its 2006 settlement of the Independent Schools case23, the schools agreed to pay £3m to a charitable trust to benefit the pupils who attended the schools during the years to which the fees information sharing related. Are these pupils who need benefiting from the arrangements?

In the lifts and escalators cartels24, the Commission imposed fines of over €990 million. The effects of this cartel may continue for twenty to fifty years as maintenance is often done by the companies that initially installed the equipment. As a result, the companies concerned have distorted these markets for years to come. What remedies could be used to eradicate or limit this distortion?

Alastair Gorrie

Orrick, Herrington & Sutcliffe

12 June 2007

1 Roundtable on Remedies and Sanctions in Abuse of Dominance Cases, DAF/COMP(2006)19. http://www.oecd.org/dataoecd/20/17/38623413.pdf

2 Competition Commission, Understanding past merger remedies: report on case study research (January 2007). http://www.oecd.org/dataoecd/20/17/38623413.pdf

3 European Commission - DG Competition, Merger Remedies Study (October 2005), page 171. http://ec.europa.eu/comm/competition/mergers/studies_reports/remedies_study.pdf

4http://europa.eu/rapid/pressReleasesAction.do?reference=IP/07/544&format=HTML&aged=0&language=EN&guiLanguage=en

5 See for example Competition Commission Corporate Plan 2007/2008 http://www.competition-commission.org.uk/our_role/corporate_plan/corporate_plan_07-08.pdf: "We estimate that our decisions in 2005/06 will have led to a benefit (reduced consumer detriment) of over £85 million a year. Assuming that these benefits last for three years, this suggests a total benefit of £250 million, compared with our expenditure that year of £22 million" (at para 3).

6 Article 7 of Council Regulation (EC) No 1/2003 of 16 December 2002 on the implementation of the rules on competition laid down in Articles 81 and 82 of the Treaty (or "Regulation 1/2003").

7 A Study of the Commission's Divestiture Process, 1999. http://www.ftc.gov/os/1999/08/divestiture.pdf

8 "Joint venture remedy" means exiting from a joint venture. The committing parties must sever permanently their joint control over a business by transferring it to a suitable purchaser. European Commission - DG Competition, Merger Remedies Study (October 2005), supra, page 141.

9 An "access remedy" is a commitment to grant access. The committing parties must provide other market participants with access to key assets and reduce barriers to entry. European Commission - DG Competition, Merger Remedies Study (October 2005), supra, page 141.

10 European Commission - DG Competition, Merger Remedies Study (October 2005), supra, page 171. The Study analysed 96 remedies, which were classified into four types according to the intended competitive effect of the remedy. The Study distinguished: (1) commitments to transfer a market position; (2) commitments to exit from a joint-venture; (3) commitments to grant access; and, (4) a small number of other commitments (from page 18 of the Study).

11 Competition Commission, Understanding past merger remedies: report on case study research (January 2007), supra, page 7.

12 Ibid.

13 Competition Commission, Understanding past merger remedies: report on case study research (January 2007), supra, page 8.

14 From Roundtable on Remedies and Sanctions in Abuse of Dominance Cases, supra, page 18.

15 From Roundtable on Remedies and Sanctions in Abuse of Dominance Cases, supra, page 9.

16 From Roundtable on Remedies and Sanctions in Abuse of Dominance Cases, supra, page 8.

17 Ibid.

18 Market Inquiries and Market Studies: The View from the Clapham Omnibus, Paul Geroski, 1 July 2005.

20 Case COMP/37.792.

21 Case COMP/A.39/.116/B2-Coca-Cola

22 IP/05/775

24 Commission decision of February 2007.

1 DYNAMIC BRAKING EFFECTIVE FROM 200711 REFER TO R13

10 LITTLEKNOWN RARELY DISCUSSED HIGHLY EFFECTIVE PRESENTATION TECHNIQUES BY

12142011 INTRODUCTION TO EFFECTIVENESS PATIENT PREFERENCES AND UTILITIES HERC

Tags: cases –, recent cases, cases, competition, remedies?, remedies, effective

- ALAPÍTÓ NYILATKOZAT 1 KÖZÖS AKARATUNK HOGY A CIVIL KEZDEMÉNYEZÉSEK

- 3 ECOLOGY & CLASSIFICATION UNIT NOTES CHARACTERISTICS OF

- PÀGINES WEB DEL SEMINARI SOBRE TIMSS I PISA

- DISABILITY STATEMENT FOR SYLLABUS DISABILITY STATEMENT DEFINITION A STATEMENT

- CONTRATTO DI APPRENDISTATO SCHEDA INFORMATIVA AD INTEGRAZIONE DELL’ISTANZA

- MUNTLIGHETSPRINSIPPET OG TILTALTES RETT TIL Å VÆRE TIL STEDE

- RESEÑA CURRICULAR SINTÉTICA BERNARDO KLIKSBERG I REFERENCIAS

- UMTPENDJ05 (PIN 22012) UNIVERSITI MALAYSIA TERENGGANU PEJABAT PENDAFTAR ARAS

- PUBLIC SPEAKING WORKSHOP DIANE T ADAMCZYK OD FAAO

- 2 25 JULY 2008 OUR CLIENT DETAILS

- LEGIONOWO DNIA…………………………… (IMIĘ NAZWISKO ADRES OSOBY SKŁADAJĄCEJ

- PARÁDSASVÁR ÖNKORMÁNYZAT TERÜLETÉN BEJELENTÉS KÖTELES KERESKEDELMI TEVÉKENYSÉG VÉGZÉSE 2011

- MINISTERIO DE ACCION COOPERATIVA MUTUAL COMERCIO E INTEGRACIÓN DE

- A1 I A2 LIGA PRVENSTVA BIH POSEBNI IZVJEŠTAJ

- STUDENT APPLICATION FORM APPLICATION DEADLINES PROGRAM SPACE

- PROCEDIMIENTOS MINISTERIO DE HACIENDA MÓDULO FM0132 PROCEDIMIENTO ELABORACIÓN

- KAUNO IKIMOKYKLINIŲ ĮSTAIGŲ VAIKŲ SVEIKATOS UGDYMO METODINĖS GRUPĖS REGLAMENTAS

- TÍTULO DEL PROYECTO “DISEÑO E IMPLEMENTACIÓN DE UN EMULADOR

- “EVALUACIÓN DEL EFECTO DE DIFERENTES INTENSIDADES DE PODA DE

- ESSAY FEEDBACK FORM USING CORE CRITERIA NB THE

- PAGE 7 SCT 2009 WL 4110975 (US)

- EAST AUSTRALIAN PIPELINE LIMITED REPORT OPTIMISED DESIGN AND COST

- BOARD OF PLUMBING AND HVACR EXAMINERS MINUTES – JULY

- ADDITIONAL PROTOCOL TO THE FRAMEWORK AGREEMENT FOR STUDENT EXCHANGES

- MISSOULA CITYCOUNTY ELECTED OFFICIALS POLICY MEETING FEBRUARY 15 2012

- MATEMATICKÝ ÚSTAV SAV SPRÁVA O ČINNOSTI ORGANIZÁCIE SAV ZA

- LISTA JEDNOSTEK W KTÓRYCH MOŻNA REALIZOWAĆ PRACE LICENCJACKIE

- UNA GENERACIÓN DE MARCAS PABLO GARCÍA RUIZ

- PERL AUTHOR LUONG MINH THANG THESE ARE MY RANDOM

- ÚNIA HYDINÁROV SLOVENSKA KRÍŽNA 52 821 08 BRATISLAVA PROGRAM

RVAČKI SAVEZ SRBIJE BEOGRAD I Z V E Š

RVAČKI SAVEZ SRBIJE BEOGRAD I Z V E ŠORDINANCE NUMBER 160 CITY OF FERNAN LAKE VILLAGE AN

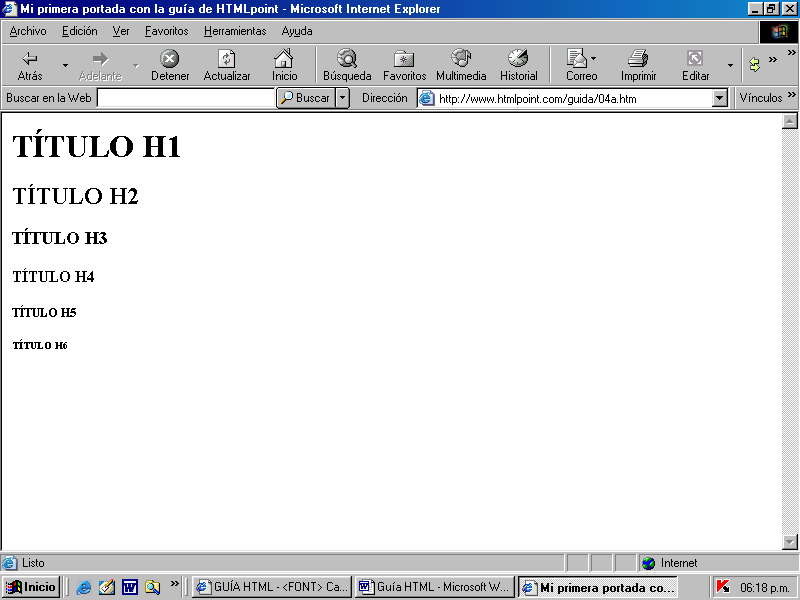

FONT FORMATEAR EL TEXTO ANTES DE ENTRAR DE LLENO

FONT FORMATEAR EL TEXTO ANTES DE ENTRAR DE LLENO OPĆINA MAČE OBRAZAC ZA PRIJAVU VLASNIKAKORISNIKA GRAĐEVINA U KOJIMA

OPĆINA MAČE OBRAZAC ZA PRIJAVU VLASNIKAKORISNIKA GRAĐEVINA U KOJIMARAZLAGA RAZPISNE DOKUMENTACIJE ŠTEVILKA 1 ZA JAVNO NAROČILO Z

PROGRAMMA JOPP (JOINT VENTURE PROGRAMME) DG XVIII

THE BUTTERFLIES OF BRICKET WOOD COMMON ANNUAL REPORT 2020

THE BUTTERFLIES OF BRICKET WOOD COMMON ANNUAL REPORT 2020PROGRAMA DE PREVENCION DEL CANCER EN EL HOMBRE Y

PLIEGO DE CLAUSULAS JURÍDICAS – PROCEDIMIENTO ABIERTO SIMPLIFICADO ABREVIADO

PLIEGO DE CLAUSULAS JURÍDICAS – PROCEDIMIENTO ABIERTO SIMPLIFICADO ABREVIADO THE FOOD CHAIN!!! EVERY LIVING THING ON EARTH DEPENDS

THE FOOD CHAIN!!! EVERY LIVING THING ON EARTH DEPENDS OBČINA KRIŽEVCI PODATKI O VLAGATELJU IME IN PRIIMEK NASLOV

OBČINA KRIŽEVCI PODATKI O VLAGATELJU IME IN PRIIMEK NASLOV H ÚSÜZEM KFT 8900 ZALAEGERSZEG GAZDASÁG ÚT 48 TEL

H ÚSÜZEM KFT 8900 ZALAEGERSZEG GAZDASÁG ÚT 48 TEL HTTPWWWCHIESADIMILANOIT RIPRENDERE E PORTARE A COMPIMENTO LA RIFORMA DEL

HTTPWWWCHIESADIMILANOIT RIPRENDERE E PORTARE A COMPIMENTO LA RIFORMA DEL RECTANGLE 2 VOTO DE MINORÍA EN EL AMPARO DIRECTO

RECTANGLE 2 VOTO DE MINORÍA EN EL AMPARO DIRECTO NETWORKS OF PATHWAYS RESULTS NETWORK MECHANISMS OF CYTOSKELETAL CHANGES

NETWORKS OF PATHWAYS RESULTS NETWORK MECHANISMS OF CYTOSKELETAL CHANGESELECTRONIC FRONTIER FOUNDATION CINDY COHN (145997) CINDYEFFORG LEE TIEN

N CSR EDUCATION FOR A SUSTAINABLE FUTURE WWWNCSRORG NORTHWEST

N CSR EDUCATION FOR A SUSTAINABLE FUTURE WWWNCSRORG NORTHWEST PRASĪBAS PLASTMASAS TVERTŅU TESTĒŠANAI NORĀDĪJUMI PIE 61527 UN

PRASĪBAS PLASTMASAS TVERTŅU TESTĒŠANAI NORĀDĪJUMI PIE 61527 UN E NCANTOS BEDUINOS DÍA 01 AMMAN LLEGADA A AMMAN

E NCANTOS BEDUINOS DÍA 01 AMMAN LLEGADA A AMMANLAB 14 EYE AND EAR EYEDISSECTION PART I EYE