20120531 DEAR REPRESENTATIVE THANK YOU FOR YOUR INTEREST IN

20120531 DEAR REPRESENTATIVE THANK YOU FOR YOUR INTEREST IN

2012-05-31

Dear Representative

Thank you for your interest in marketing Funeral Plans. Please consider the following information presented. If there are any other enquiries, please contact our offices.

We look forward to working with you.

Calculations of potential income:

|

Age |

18 - 64 |

64 – 74 |

74 - 85 |

|

Premium |

R78 |

R98 |

R131 |

Included in the premium, as indicated above, is the suggested income pay outs for Reps

|

Representative per policy per month |

R20 |

R20 |

R20 |

Profcon, as the developers of Bantu Bonke are responsible for all the administration matters for this product, which is underwritten by Group Assupol Life Limited in Pretoria. Our preferred method of marketing is through Reps and funeral homes and efficient administration is our speciality. Bantu Bonke/Ufunco our schemes offers a competitive premium as all clients are pooled together strengthening our tariff structure with Assupol Life Limited to keep premiums low.

The following administration services from Profcon can be enjoyed:

We receive the fully completed application forms and documentation

Load all client information into the database

We do the premium collection and are responsible for the Debit Order run

We handle the processing of all death claims, Group Assupol Life Limited in Pretoria pays the claims

We are also responsible for the monthly payroll to Reps on the 15th of every month on the previous months premiums received

We supply the template for the application and disclosure forms (attached in separate email) and sign-off any marketing material

We will supply or you can make print your own marketing material and application forms

As Representatives:

For compliance, we deduct the necessary amount for your own FSB license fee

Representatives carry their own expenses including, but not limited to telephone expenses, postal expenses and stationary expenses (no advances)

No cash payments to be received by any representative

Representatives are responsible to follow up their business with the office

Targets will be discussed and set with representatives.

Representatives who have been inactive/out of production for 3 months forfeit their commission which remains with the active broker house.

NB: production should be continuously consistent to minimize the risk. New business on the books covers those clients who’ve completed their waiting period.

Please find attached a Profcon Application form. Representatives are required to fill this out and send originals back to Profcon.

Bantu Bonke / UFUNCO

(Persal Stop Orders and Debit Order)

We have two schemes Bantu Bonke and Ufunco. An individual may only be cover once per scheme.

Please find herewith attached the necessary documentation and application form. The application form has been compressed for quicker and easier transfer via email and is made up of individual compressed folders labelled:

1 Bantu Bonke application A4, the front and the back of the first page

2 Life Insurance Advice, front of the second page

3 Funeral Check and Needs Analysis, back of the second page

4 Bantu Bonke Member Certificate, front of the third page

5 Assupol-on-Call, back of third page

This is a three page application.

Signed applications, the front and back of first page, may be faxed or scanned and Emailed to Profcon for capturing on a weekly basis. The original application and advice record must be sent to Profcon before the end of every month, once a month.

With Stop Order clients the original application and a payslip no older than three months is required. The deadline for Stop Order business is the 20th of every month. If the 20th falls on a weekend then business needs to be submitted on the Friday before the weekend.

Debit Order strike dates are on the following days of every month (1, 3, 7, 15, 20, 25)

All debit order business must be submitted 5 days in advance of indicated strike date on application.

No premium – auto lapse unless double premium received by the 7th of the next month.

NB: The banking particulars are very important. Debit Orders are branch code specific and there must be clearly indicated what type of account it is, savings, cheque or transmission. All Stop Order clients’ whose policy fails to deduct or Q-link fail on the system will go through on Debit Order. The Debit Order section should therefor always be signed on the application and marketers must inform clients that that is how it will be done if their Stop Orders fail to deduct.

The government Q-link system (Stop Order clients) also require that the Main Life Assured on the policy must be the policy payer. On Debit Order, the premium payer can either be the Main Life Assured or the Beneficiary. (Beneficiaries must have and insurable interest in the Main Life Assured.)

Premiums are to be calculated according to the oldest member between main life assured and his/her spouse. If a 65 – 85 year old proposer would like to cover their children under the age of 21 years they are required to cover them as extended family. Children are covered up to the age of 21 years of age, thereafter they are to apply for their own policies.

Premium may increase as claim experience necessitates.

Marketers earn R20 commission per case irrespective of how many people are covered and how many dependents are added. Commission is earned per case, so we advise that extends should be written on their own policy.

There is a 6 month waiting period for policy holders under the age of 65 years of age and a 9 month waiting period for policy holders over the age of 65.

Accidental death is covered after the receipt of first payment at Assupol and there is a 2 years waiting period for suicide cases.

Funeral claims paid in cash.

The benefits of Assupol-on-call are automatically included. (Attached)

The policy starts as soon as the first premium has been received. Accidental cover is covered from the receipt of first payment. The waiting period and cover starts 6 calendar months after the receipt of first payment.

Example: a policy that deducts on the 15th of a month will start on the 1st of the following month. The waiting period is 6 calendar months from the start of the month.

Premiums are payable in advance. Clients are responsible to see that their policy deducts every month. Premiums deducted from the state take a little longer to reach Assupol, as we do not want any claw-backs.

Lastly, marketers must never stop writing new business. The risk of your book will increase as there are no new members with waiting periods carrying the risk of clients who are no longer in their waiting period. Marketers with less than 200 cases on the books, who stop producing new business, will forfeit their recurring commission to carry the risk of their clients. Production must be consistent.

As mentioned above, clients can only get assured once per scheme.

Please contact Jenni (049-89 22887) or myself if you have any queries and we will gladly help you.

Regards

Fanie Bezuidenhoudt

Stephanus Johannes George Bezuidenhoudt t/a FB Makelaars/Profcon FSB 3493 Masthead 902104 FIA 26001886 [email protected]

Tel: 049 89 22887

Cell: 084 706 9494

PO Box 94,

82 Somerset Street,

Graaff Reinet, 6280

An Authorised Financial Service Provider

Tags: interest, thank, 20120531, representative

- ZÁRUČNÍ A POZÁRUČNÍ SERVIS SPOTŘEBIČŮ ZNAČKY AMICA ZAJIŠŤUJE FIRMA

- THE UNIVERSITY OF WEST LONDON TEACHING AND LEARNING CONFERENCE

- PAUTA ACTIVIDADES CONSTRUIR Y MEDIR ÁNGULOS CON EL TRANSPORTADOR

- ASIGNATURA ANATOMÍA ESPACIO FAF 1º B DOCENTE HORARIO Nº

- INFORME SOBRE TETRAHIDROBIOPTERINA COMISIÓN DE FARMACIA Y TERAPÉUTICA HOSPITAL

- UTILITY SERVICES IN ROAD RESERVES DOCUMENT NO 150110 THE

- PATIENT LABEL HERE SURGICAL CONTRACTS BOOKINGWAITLIST REQUEST S SURGICAL

- THE FREE TO SPEAK CAMPAIGN CAMPAIGN LAUNCH STATEMENT NEWS

- BANCO CENTRAL DEL URUGUAY UNIDAD DE INFORMACIÓN Y ANÁLISIS

- MELLÉKLET EGYÜTTMŰKÖDÉSI MEGÁLLAPODÁSHOZ EGYÜTTMŰKÖDŐ FÉL ME FELELŐS EGYÜTTMŰKÖDÉS KEZDETE

- CENTRO DE DOCUMENTACIÓN CIDAP FUENTE EL COMERCIO FECHA LUNES

- LA NECESIDAD DEL DEBATE BIOÉTICO AMBIENTAL EN LA EDUCACIÓN

- OPAKOVÁNÍ 8 ROČNÍKU I POLOLETÍ 1 KDY SE KONÁ

- CONFIGURACIONES DE LA TRANSFERENCIA MASOQUISMO Y SEPARACION DAVID LAZNIK

- JUDGE NINA ASHENAFI RICHARDSON INNS OF COURT TEAM PRESENTATION

- LEATHER TANNERIES IN INDIA RAVI TANNERIES PVT LTD 17

- COMMUNICATION AND THE FULL RANGE LEADERSHIP MODEL A STUDY

- ZAKŁAD UBEZPIECZEŃ SPOŁECZNYCH OŚWIADCZENIE O STANIE RODZINNYM I MAJĄTKOWYM

- NAME GRADE AGE M OR F

- STANOVENÍ DOBY DOSAŽENÍ CÍLOVÉ SRDEČNÍ FREKVENCE 130MIN A DOBY

- N° DECRETO 359379 N° EXPEDIENTE 031992017TCE FECHA DEL DECRETO

- UNIVERSIDAD INTERNACIONAL MENÉNDEZ PELAYO DECLARACIÓN RESPONSABLE PARA LA REALIZACIÓN

- SOLIDARANSVAR OG LØNN MALER FOR Å FREMME LØNNSKRAV ET

- TC KÜLTÜR VE TURİZM BAKANLIĞI İSTANBUL II NUMARALI YENILEME

- BENCHES AND PEDESTALS BENCHES PROVIDE MANUFACTURERS STANDARD 114 THICK

- 20102011 DRAFT IDP AND BUDGET PUBLIC CONSULTATION NOTICE IS

- RESUMEN CON EL OBJETIVO DE ANALIZAR EL EFECTO DEL

- STRETCHING – DOMOWA METODA NA SPRAWNE CIAŁO ANALIZUJĄC WIĘKSZOŚĆ

- III (AB ANTLAŞMASI KAPSAMINDA KABUL EDILEN TASARRUFLAR) AVRUPA BİRLİĞİ

- GRANDEZA LITERARIA Y MISERIA MORAL EN LA ESPAÑA DE

DAFTAR KEPUTUSAN DPRD KABUPATEN KARANGANYAR TAHUN 2015 NOMOR URUT

NEWS RELEASE FOR IMMEDIATE RELEASE MAY 20 2021 FOR

NEWS RELEASE FOR IMMEDIATE RELEASE MAY 20 2021 FOR LAS ROPAS Y LOS CUERPOS DE LOS PRODUCTORES DE

LAS ROPAS Y LOS CUERPOS DE LOS PRODUCTORES DE PRELIMINARY SCREENING REPORT FORM PRELIMINARY SCREENER MVLWB REFERENCE

PRELIMINARY SCREENING REPORT FORM PRELIMINARY SCREENER MVLWB REFERENCE ANNEXUREX COMPREHENSIVE ABORTION CARE STATE MONITORING FORMAT (QUARTERLY) PLEASE

PONTIFICIA UNIVERSIDAD CATÓLICA DEL ECUADOR FACULTAD DE JURISPRUDENCIA 1

PONTIFICIA UNIVERSIDAD CATÓLICA DEL ECUADOR FACULTAD DE JURISPRUDENCIA 1 MANUALE E CHECK LIST PER LA VIGILANZA E I

MANUALE E CHECK LIST PER LA VIGILANZA E I ISTOTNE POSTANOWIENIA UMOWY DZP26032021 UMOWA ZAWARTA W DNIU ………………

ISTOTNE POSTANOWIENIA UMOWY DZP26032021 UMOWA ZAWARTA W DNIU ………………BƯỚC SEN TRONG CÕI TỊNH ĐỘ TSAO FASHIH O0O

25 GENETIC TASTE BLINDNESS TO BITTER AND BODY COMPOSITION

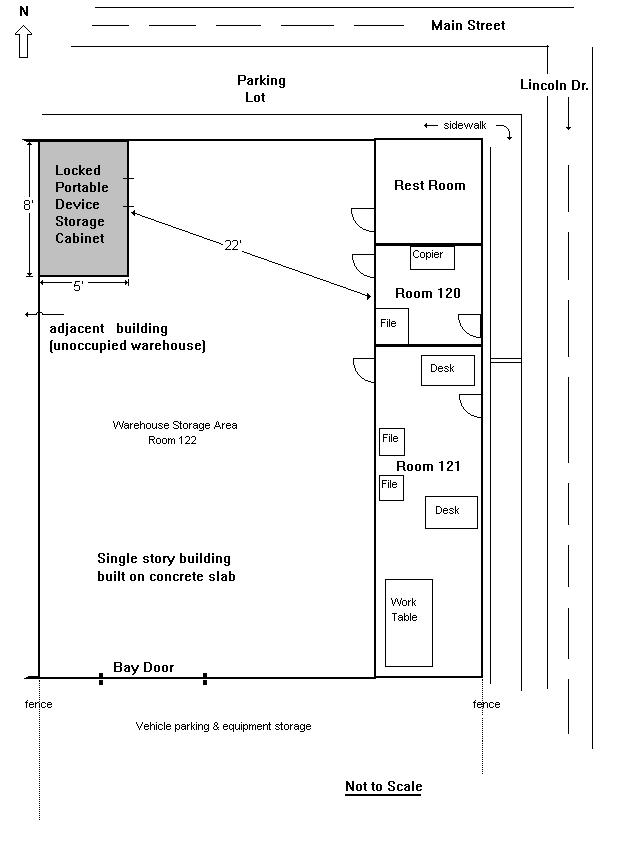

SAMPLE FACILITY DIAGRAM PG EX A (SAMPLE FACILITY DIAGRAM)

SAMPLE FACILITY DIAGRAM PG EX A (SAMPLE FACILITY DIAGRAM) CLARKE ELEMENTARY SCHOOL CRISIS RESPONSE MANUAL 20142015 TABLE OF

CLARKE ELEMENTARY SCHOOL CRISIS RESPONSE MANUAL 20142015 TABLE OFПОСТАНОВЛЕНИЕ ПРАВИТЕЛЬСТВА КР ОТ 30 АВГУСТА 2019 ГОДА №

W NASZEJ SZKOLE KAŻDY JEST WAŻNY CZUJE SIĘ BEZPIECZNY

W NASZEJ SZKOLE KAŻDY JEST WAŻNY CZUJE SIĘ BEZPIECZNY3 OF 3 PROPOSED SIMPLIFICATION OF UNIVERSITY PROCEDURES REGARDING

ОБРАСЦИ O 4291 ОПШТИНА ШАМАЦ СТРАНА 1 ОД 1

3TECHNOLÓGIAI MEGOLDÁSOK FÖLDMUNKA FÖLDKIEMELÉS AZ ÖSSZES FÖLDKIEMELÉSI ÜTEM MARKOLÓGÉPPEL

Programa de Sociologia Modulo 1 la Sociologia Como Ciencia

Programa de Sociologia Modulo 1 la Sociologia Como CienciaRETURN REQUIREMENTS COMPLIANCE WITH THE INSTRUCTIONS BELOW WILL ENSURE

TANTÁRGY SZÁMÍTÓGÉP ARCHITEKTÚRA OKTATÓ DR BOHUS MIHÁLY KÉSZÍTETTE PÁLL

TANTÁRGY SZÁMÍTÓGÉP ARCHITEKTÚRA OKTATÓ DR BOHUS MIHÁLY KÉSZÍTETTE PÁLL