EMSSLALS PAYROLL APPRENTICESHIP – COURSE BREAKDOWN MODULE 1 PAYROLL

EMSSLALS PAYROLL APPRENTICESHIP – COURSE BREAKDOWN MODULE 1 PAYROLL

EMSS/LALS Payroll Apprenticeship – Course Breakdown

MODULE 1: PAYROLL (CORE)

Session 1

Introduction to the course

The role of the payroll function

List the overriding legislation in respect of the following areas and describe why it is important to have a working appreciation of these:

Employment law (including relevant case law)

Payroll law (i.e. tax and Social Security legislation)

Pension law (specifically for workplace pensions / Auto-Enrolment)

Describe the impact of devolution on the payroll function

Session 2

Identify the following at your workplace:

Pay methods (cash, BACS etc.)

Pay frequencies (weekly, monthly etc.)

The payroll deadlines for each payroll

Recognise and distinguish between the following different types of worker that may exist in the payroll function and how the differences impact the payroll function:

Employee (essential)

Apprentices

Deemed worker

Self-employed

Pensioner

Worker

Office holder

Volunteers

Session 3

Describe the following types of pay and discuss how these are derived:

Gross

Taxable pay

NI’able

Pensionable

Pay for the Apprenticeship Levy

Pay for Student Loan deductions

Describe each of the Real Time Information (RTI) submissions and explain their purpose in the payroll function.

Session 4

Recognise and describe the following statutory payments and deductions:

Income Tax

National Insurance Contributions (including directors’)

Student Loans

Statutory Sick Pay (SSP)

Statutory Maternity Leave and Pay

Statutory Adoption Leave and Pay

Statutory Paternity Leave and Pay

Statutory Shared Parental Leave and Pay

The Apprenticeship Levy

Recognise the principles of the Construction Industry Scheme (CIS)

Recognise the principles of benefits in kind (including payrolling), OpRA and year-end reporting obligations

Recognise the principles of Court Orders in the United Kingdom

Recognise and describe Gender Pay Gap Reporting as it may affect the payroll function

Identify and describe the relevant sources of guidance

MODULE 2: PENSIONS FOR PAYROLL

Session 5

Recognise the relevance of the State Pension in terms of:

Age reforms

State Pension reforms

Define the different types of pension scheme arrangements and key terminology:

Defined Contribution

Contract-based and occupational trust-based schemes

Defined Benefit

Public Sector

Personal

Additional Voluntary Contributions

Describe the UK system of pensions tax relief including:

Net Pay Arrangement schemes

Relief at Source schemes

Interaction with OpRA

Annual Allowance

Lifetime Allowance

Broadly describe pensions flexibility

Recognise the key differences when administering pension payrolls in terms of:

NI position

Tax position

Payslips

Session 6

Understand, explain and interpret workplace pensions / Auto-Enrolment in terms of:

The employer’s role in pension provision

Staging / duties start date

The qualifying pension scheme, including self-certification

Declaration / re-declaration of compliance

Employer duties for different workers

Qualifying earnings and the Automatic-Enrolment processes

Deferral, Opt ins / outs and cessations

Monitoring worker status and Re-Enrolment

Communicating with different workers

Identify and describe the relevant sources of guidance

MODULE 3: PAYROLL (TECHNICAL)

Session 7

Recap of the different types of worker

Recap of the different types of pay

The new starter

The P45

The Starter Checklist

No or late P45 / Starter Checklist

Pension payroll starters

Deemed worker starters

Voluntary deductions (e.g. union subscriptions)

Session 8

Manual calculation of Income Tax

Session 9

Manual calculation of NICs (not including directors’) on all category letters

Session 10

Manual calculation of pension contributions

Manual calculation of Student Loans

Manual calculation of the Apprenticeship Levy

Session 11

Manual calculation of sickness and child-related payments (e.g. SSP, SMP)

Session 12

Gross to net calculations

Overpayments and underpayments

The leaver

The P45

Payments after leaving

Processes and obligations after the payroll run:

Reconciliation

RTI

Obligations to internal and external organisations (i.e. accounts, audit, pension schemes etc.)

Identify and describe the relevant sources of guidance

MODULE 4: REGULATION AND COMPLIANCE

Session 15

In respect of statutory regulation and compliance, describe the fundamentals of payroll processing at their organisation

Identify and document the main taxation, Social Security, employment and pensions legislation that exists in the United Kingdom

Describe the impact of this legislation on their role, focusing on the obligation to comply and the consequences of non-compliance

Evaluate the regulatory bodies that publish compliance guidance and recognise those bodies that apply to payroll processing at their organisation, including workplace pensions

Identify and document the compliance and penalty regimes that apply to payroll processing at their organisation, including workplace pensions

Appreciate and apply the principles of data protection / confidentiality at their organisation

MODULE 5: SYSTEMS AND PROCESSES

Session 16

Identify the main workplace, payroll, HR, pension and accounting systems and processes relevant to the job role and evaluate how these support the payroll function

With regards the input and validation of data to output of payroll / accounting information, explain the occupational proficiency required for at least one computerised payroll system used in the workplace

If applicable, describe your use of a spreadsheet package such as Microsoft Excel in the workplace and, specifically, in your role

Describe how the use of systems and processes supports timely and accurate payroll processing in the workplace

Tags: payroll apprenticeship, accurate payroll, payroll, apprenticeship, course, breakdown, emsslals, module

- FORMULARIO DE IDENTIFICACION DEL OFERENTE COMPRA DIRECTA POR

- ESQUEMA PARA FACILITAR UNA CHARLASESIÓN [SE ENTIENDE QUE ESTE

- “2019 AÑO DE LA EXPORTACIÓN” SOLICITUD DE APOYO

- PLIEGO DE CLAUSULAS ADMINISTRATIVAS PARTICULARES Y TECNICAS QUE REGIRA

- ACTIVITAŢI CULTURALE DESFASURATE DE UNITATILE ADMINISTRATIVE ORAŞELE ŞI

- WORKFLOW TOOL FOR ENGINEERS IN A GRIDENABLED MATLAB ENVIRONMENT

- COLLECTION OF CHILDREN POLICY WE WILL DO ALL IN

- MEGRENDELŐ 2021 ÉVI GYAKORLATI SZEMINÁRIUMOKRA MEGRENDELŐ KÖLTSÉGVISELŐ (INTÉZMÉNY

- SERVICIO NO DISPONIBLE POR MOTIVOS DE MANTENIMIENTO DE LOS

- SECRETARÍA GENERAL SUBDIRECCIÓN DE SISTEMAS DE TECNOLOGÍAS DE LA

- PERIPHERAL CRATE ELECTRONICS PERIPHERAL CRATE TRAVELER WITH TESTING INSTALLATION

- ANEXO Nº 16 RESIDUOS PELIGROSOS SUJETOS AL CONVENIO DE

- PRACTISING SPIRITUAL DISCIPLINES THE DISCIPLE NEEDS TO BEGIN TO

- RADICACIÓN N° 40001310300420070007901 RESPONSABILIDAD CONTRACTUAL DEL CONSTRUCTOR–POR VENTA DE

- ESCRITO DIRIGIDO AL SERVICIO DE RECLAMACIONES DEL BANCO DE

- MATERIAŁ NA STRONĘ INTERNETOWĄ HTTPBIPABWGOVPL OGÓLNE INFORMACJE NA TEMAT

- AGNIESZKA PAWELCZYK KSZTAŁTOWANIE POSTAWY EMPATII NA LEKCJACH ETYKI WOBEC

- CDR PATRIMONIO N D’ORDINE CONTRATTO DI CONCESSIONE L’ANNO DUEMILADICIASSETTE

- 13 ORIGINAL COLONIES DIALOGUE PART 1 SPEAKER ONE

- EVIDENCE I MADE A B+ IN THIS CLASS I

- FORTALECIENDO LA CONFERENCIA REGIONAL SOBRE MIGRACIÓN A OCHO AÑOS

- PATVIRTINTA VILNIAUS ŠV KRISTOFORO GIMNAZIJA DIREKTORĖS 2015 M VASARIO

- VULCANUS IN JAPAN 20212022 HOW TO APPLY (4 STEPS)

- TCE CONTAMINATION AND CLEANUP CURRICULUM A GRASSROOTS CAMPAIGN EVOLVES

- CONTOH URUTAN MENGERJAKAN TUGAS 1 SOAL TUGAS 2

- PROCESO ADQUISICIÓN DE BIENES Y SERVICIOS FORMATO ESTUDIOS Y

- NÚMERO DE CONFIRMACIÓN QS6VDS VUELO SALIDA LLEGADA MADATH VY6122

- OFICINA DE GESTIÓN DOCUMENTAL Y ARCHIVO FORMULARIO DE SOLICITUD

- STUDY INTO THE REINDEER ON SOUTH GEORGIA FOLLOWING SIX

- Fulltime Position (37 Hours) Will be Monday to Friday

A 2003 ÉV NOVEMBER 30IG OKTATÁSBA BEVONT JÁRMŰVEKRE VONATKOZÓ

HEALTH SUPPORT PLAN FOR EDUCATION CHILDCARE AND COMMUNITY SUPPORT

HEALTH SUPPORT PLAN FOR EDUCATION CHILDCARE AND COMMUNITY SUPPORT BIBLE PROPHECIES OF MUHAMMAD نبوءات الإنجيل عن محمد صلى

BIBLE PROPHECIES OF MUHAMMAD نبوءات الإنجيل عن محمد صلىBEOORDELINGSFORMULIER (RUBRICS) PROEVE VAN BEKWAAMHEID 2 HET ONTWERPPLAN AAN

QUE EL HONORABLE AYUNTAMIENTO CONSTITUCIONAL DEL MUNICIPIO DE LEÓN

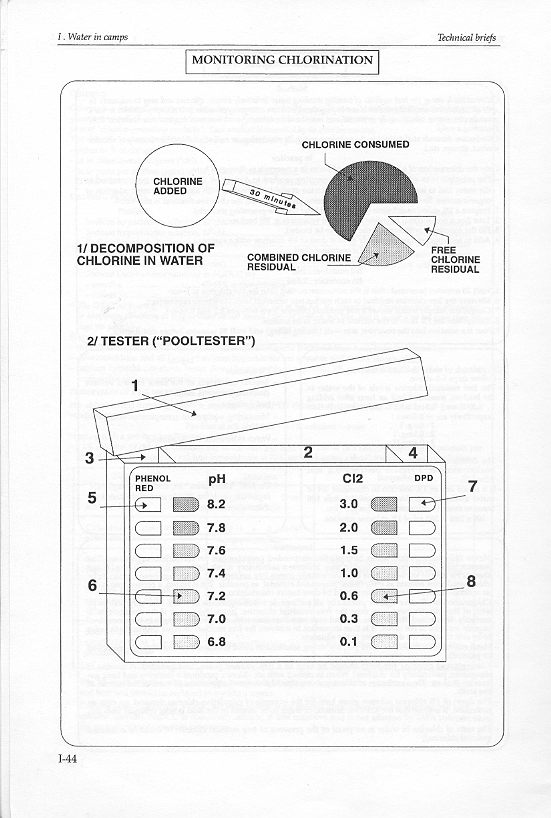

QUE EL HONORABLE AYUNTAMIENTO CONSTITUCIONAL DEL MUNICIPIO DE LEÓN SESSION 32 HANDOUT 4 MONITORING OF CHLORINATION

SESSION 32 HANDOUT 4 MONITORING OF CHLORINATIONPROJEKT USTAWA Z DNIA ………… 2012 R O ZMIANIE

FORM NO DFC 37 REV 122016 CLAIM FOR REIMBURSEMENT

EL USO DE RECURSOS DIGITALES ABIERTOS Y SU IMPACTO

EL USO DE RECURSOS DIGITALES ABIERTOS Y SU IMPACTO THE APPLICATION OF EXPERT SYSTEMS IN ACCOUNTING1 DAVID

THE APPLICATION OF EXPERT SYSTEMS IN ACCOUNTING1 DAVIDSTOFFTOKSIKOLOGI – RADIOAKTIVE STOFFER OG KARSINOGENER K40KALIUMISOTOP

Just Start Walkingstraighten up Name Personal Activity Calendar

USULSÜZLÜK CEZALARINA AİT CETVEL MÜKELLEF GRUPLARI BİRİNCİ DERECE USULSÜZLÜKLER

O GÓLNOPOLSKI PROGRAM EDUKACYJNOALTERNATYWNY KSZTAŁTUJĄCY POZYTYWNE ZACHOWANIA DZIECI I

O GÓLNOPOLSKI PROGRAM EDUKACYJNOALTERNATYWNY KSZTAŁTUJĄCY POZYTYWNE ZACHOWANIA DZIECI I UNIVERSIDAD DE BURGOS FACULTAD DE CIENCIAS DEPARTAMENTO DE QUÍMICA

UNIVERSIDAD DE BURGOS FACULTAD DE CIENCIAS DEPARTAMENTO DE QUÍMICAARCHIVES OF ENVIRONMENTAL PROTECTION INSTRUKCJA DLA AUTORÓW ARCHIVES OF

PROJET DE PLAQUETTE DE PRESENTATION N°1 « RIEN DE

PROJET DE PLAQUETTE DE PRESENTATION N°1 « RIEN DE SURPLUSGALLERY SCHOOL OF ART AND DESIGN MAIL CODE 4301

SURPLUSGALLERY SCHOOL OF ART AND DESIGN MAIL CODE 4301 THE REBOUND EFFECT AN ASSESSMENT OF THE EVIDENCE FOR

THE REBOUND EFFECT AN ASSESSMENT OF THE EVIDENCE FOR COMUNIDAD ANDINA SECRETARIA GENERAL RESOLUCIÓN 036 11 DE DICIEMBRE

COMUNIDAD ANDINA SECRETARIA GENERAL RESOLUCIÓN 036 11 DE DICIEMBRE