HR125 STAFF TUITION RATES NOTES FORMS MUST BE

HR125 STAFF TUITION RATES NOTES FORMS MUST BE

HR125 - Staff Tuition Fee Rates

|

HR125 |

STAFF TUITION RATES |

|

NOTES

Forms must be downloaded from the UCT website: http://forms.uct.ac.za/forms.htm

For UCT policy regarding tuition fee rates, see: http://www.hr.uct.ac.za/hr/benefits/remuneration/staff_tuition_rates/

This form must be completed and sent to the HR Business Partner who serves your department.

The sections ‘Employee Details’ and ‘Student Details’ must be completed by the employee or retiree.

Please be clear about the year of registration for which the tuition fee rates are being claimed.

For more information regarding completing this form and on fringe benefit tax, see: Page 2.

EMPLOYEE DETAILS

|

Surname |

|

Staff Number |

|

|||||||||||||

|

First Names |

|

Title |

|

Contact Number |

|

|||||||||||

|

Relationship to Student |

|

Are you on the UCT Payroll? (tick) |

Y |

N |

||||||||||||

|

Email Address |

|

|||||||||||||||

|

Department |

|

Position |

|

|||||||||||||

|

Full-time or Part-time? (tick) |

FT |

PT |

If Part-time, Number of Hours per Week |

|

||||||||||||

|

If not on UCT payroll |

||||||||||||||||

|

Conditions of Service |

Joint |

Other |

If other, relationship to UCT |

|

||||||||||||

|

Department |

|

Position |

|

|||||||||||||

|

Period of Appointment |

From (ddmmyyyy) |

|

To (ddmmyyyy) |

|

||||||||||||

|

Full-time or Part-time? (tick) |

FT |

PT |

If PT Medical Staff, Number of Teaching Sessions per Week |

|

||||||||||||

|

Address |

|

|||||||||||||||

|

|

Postal Code |

|

||||||||||||||

STUDENT DETAILS

|

Surname |

|

Student Number |

|

||||||

|

First Names |

|

Marital Status |

|

||||||

|

Date of Birth (ddmmyyyy) |

|

If student is a child, attach certified copy of birth certificate |

|||||||

|

Identity Number |

|

If student is a child, attach certified copy of identity document |

|||||||

|

If the application is for a child, are they financially dependent on the staff member? |

N/A |

Y |

N |

||||||

|

Term Address |

|

||||||||

|

|

Postal Code |

|

|||||||

|

Telephone Number |

|

||||||||

|

Current Registration e.g. BA, BSc(Hons) |

|

||||||||

|

Year of application for staff tuition rate |

|

Full-time? (tick) |

Y |

N |

|||||

|

If you selected "N" for full time (i.e. part time) for your dependent or spouse, is the qualification only offered part-time? |

Y |

N |

|||||||

CERTIFICATION

|

Signature of Employee/Retiree |

|

Date |

|

|

I certify that the above employee and student details are correct. I agree to the required SARS fringe benefit tax deductions (applicable to a benefit greater than 75%). Please refer to notes on page 2 and Fringe Benefit Tax Calculator - COE Calculator. |

|||

AUTHORITY FOR RATES

|

|

PRINT NAME |

SIGNATURE |

CONTACT NO. |

DATE |

|

Head of Department |

|

|

|

|

|

I confirm that the above appointment details are correct. |

||||

|

HR Business Partner |

|

|

|

|

FOR OFFICE USE

|

HR |

Code |

|

|

|

Pro-rata Indicator |

|

Relationship (tick) |

Sp |

S |

D |

M |

E |

||||||

|

Staff Rate approved? (tick) |

Y |

N |

If Yes |

% |

If No, give reason |

|

||||||||||||

|

Fees |

Action (tick) |

A |

C |

D |

Staff differential fee |

% |

Captured by |

|

||||||||||

COMPLETING A STAFF TUITION RATES FORM

HR125

When do I complete this form?

This form is completed when an employee, retiree, Joint Medical Staff member, UCT Council member or SACS employee wishes to apply for staff tuition rates in the case of him/herself, his/her spouse or life partner, or his/her children in accordance with the policy. This form must be completed for each year of study.

What is fringe benefit tax and how is it calculated?

Fringe benefits tax will be applied, as applicable, based on the prevailing South African Revenue Services regulations for a benefit greater than 75%.

The calculation is: (Your total tuition fee) multiplied by (25% minus the rate you are paying) multiplied by (your marginal tax rate).

For

example:

If you are studying an MBA with a total tuition fee of R 250 000 and

your earnings are taxed at a marginal tax rate of 41% the tax applied

would be as follows: R 250 000 x (25%-0%) x 41% = R 25 625.

This

will be deducted over four months (i.e. from September to December)

for each respective year of study.

For a tool to calculate your approximate annual tax, see: Fringe Benefit Tax Calculator - COE Calculator (http://www.hruct.co.za/FringeBenefitCalculator ).

What important rules do I need to be aware of when completing this form?

Please refer to the UCT Staff Tuition Policy http://www.hr.uct.ac.za/hr/benefits/remuneration/staff_tuition_rates/ to check the rates you are eligible for.

Children only qualify if they are financially dependent on the employee.

If you are the dependant of a deceased staff member, complete this form giving details of the deceased and your relationship to him/her.

Staff tuition rates may apply on a pro-rata basis (approved in quarters), where you are not employed for the full year. For example, if you are employed for 1-5 months of the year: 1 quarter will be approved, 6-8 months of the year: 2 quarters will be approved, 9-11 months of the year: 3 quarters will be approved.

Staff tuition rates apply to the year of application only and will not be approved retrospectively.

If it is indicated that the course is going to be taken full time for your spouse or dependant (i.e., Y is selected for Full-time? field), and through an audit it is found that the qualification is not offered full-time, UCT has the right to reverse the rebate.

International staff members and their dependents who qualify for the staff tuition rate are not charged the international term or international admin fee.

For all MMed and MPhil (for sub-speciality training) degrees the staff tuition rate has already been applied to the fee published in the Student Fees Handbook.

The

University Council has determined that students who qualify for both

a tuition fee at the staff tuition rate, and a UCT- funded

scholarship (Entrance, Faculty, VC, Achievement), will have the

scholarship adjusted equivalent to the staff tuition rate

percentage.

For

example:

Where the staff tuition rate means a fee that is 10% of the full

tuition fee, the scholarship will be paid at the level of 10% of its

full value. The adjustment will be processed after the staff tuition

rate has been processed by the Fees Office. The scholarship will

initially be awarded in full, as the Funding Office is unaware of

who qualifies for the staff tuition rate until such time as the

application is processed.

Where do I send this form?

This form should be sent:

first to your Head of Department for confirmation of the employment details,

then to your HR Business Partner for approval – and,

finally, your HR Business Partner will forward it to the Fees Office

When do I submit this form?

Prior to the commencement of studies but within the year of registration, no later than 15 August of the current registration year.

What other documents do I need to submit?

If a child is over 28 years of age, details of his/her income and proof of financial dependence (affidavit and bank statements) must be submitted.

If a child is adopted, proof of adoption must be submitted.

14

October 2021

Page

Tags: forms must, notes, tuition, staff, rates, hr125, forms

- LAS MALAS HIERBAS COMO RECURSOS GENÉTICOS K HAMMER¹ TH

- AUTORITÉ DE CONTRÔLE PRUDENTIEL DÉCLARATION MODIFICATIVE D’UN CHANGEUR MANUEL

- KALENDARZ ODBIORU ODPADÓW KOMUNALNYCH OD MIESZKAŃCÓW MIASTA I GMINY

- 52222 KOROMAČNO KOROMAČNO 1 OIB 93627811741 IBAN HR91

- GUIÓN HANGOUT Y PRIMEROS DÍAS EN PRIMER

- 31995R1484 UREDBA KOMISIJE (EZ) BR 148495 OD 28 LIPNJA

- DIETARY INCLUSION OF 10 SEAWEEDS IN SENEGALESE SOLE (SOLEA

- 231 SSI MODELLERINGSKOMPETENCE OPGAVEEKSEMPEL UDARBEJDET PÅ TEC –

- HOLGERS A2 POCKET (I CALLERLABS INLÄRNINGSFÖLJD VID DENNA

- BIDASOA ZONALDEKO ESKOLARTEKO XAKE TXAPELKETA ALEBIN ETA INFANTIL MAILA

- REPUBLIKA HRVATSKA PRIJEDLOG KARLOVAČKA ŽUPANIJA GRAD KARLOVAC GRADSKO VIJEĆE

- CLASIFICACIÓN 79 CAMPIONAT DE SABADELL FECHA 050409

- ZAŁĄCZNIK NR 4 DO SIWZ ZPPN112019 ZAMAWIAJĄCY OPERA WROCŁAWSKA

- ACTION PLAN FOR IMPLEMENTATION OF PATIENT AND CARER INVOLVEMENT

- JOSEP SANTESMASES I OLLÉ VILARODONA 1951 DE FORMACIÓ

- 8TH INTERNATIONAL CONGRESS AND 13TH NATIONAL OF CLINICAL PSYCHOLOGY

- APPLYING FOR A DETERMINATION FROM EALING SACRE MAINTAINED SCHOOLS

- 6005 WIS JI‑CRIMINAL 6005 6005 CONTROLLED SUBSTANCE ANALOG —

- NAME PERIOD VIRGINA PROVINCE WORKSHEET 1 THE

- ÀREA D’ECONOMIA INNOVACIÓ I SERVEIS CENTRALS AGÈNCIA TRIBUTÀRIA DE

- IKATES SRO AUTORIZOVANÁ OSOBA Č 225 NOTIFIKOVANÁ OSOBA Č

- NA TEMELJU ČLANKA 26 ZAKONA O PREDŠKOLSKOM ODGOJU I

- KLASA0230115016 URBROJ21380602151 LUMBARDA2 TRAVNJA 2015 NA TEMELJU ČLANKA 20

- SUBSECRETARÍA REGIONAL DEMARCACIÓN HIDROGRÁFICA DE PASTAZA INFORME PRELIMINAR DE

- 120 DIREKTORAT PEMBINAAN PENDIDIKAN KHUSUS DAN LAYANAN KHUSUS PENDIDIKAN

- PUBLIC QUESTION TIME PLEASE SEE ATTACHED GUIDELINES FOR PARTICIPATION

- PASIENTINFORMASJON OM VAGIFEM® VI HAR MOTTATT HENVISNING FRA DIN

- MATERIAS PROPIAS DE LA MODALIDAD DE CIENCIAS Y TECNOLOGÍA

- THERMOMETER READOUTS FOR RTD PRT AND THERMISTOR SENSORS 1502A

- PAUTA MULTIPLICAR DECIMALES POR DECIMALES YA SABES QUE MULTIPLICAR

NK IZ ZASTUPAN PO ( U

MODELO IRG3 CERTIFICADO DE INSTALACIÓN INDIVIDUAL DE GAS EMPRESA

COLLEGE CONTACTS BELOW ARE LINKS AND CONTACT INFORMATION FOR

WC6 – VERSION 21 (22062020) GUIDANCE NOTES WINDOW CLEANERS

WC6 – VERSION 21 (22062020) GUIDANCE NOTES WINDOW CLEANERS TEMAT „JEST TAKI ŻE AŻ DECH ZAPIERA” O

TEMAT „JEST TAKI ŻE AŻ DECH ZAPIERA” OKRAJSKÁ HYGIENICKÁ STANICE PARDUBICKÉHO KRAJE SE SÍDLEM V PARDUBICÍCH

METODOLOGIA DE LA INVESTIGACION CUALITATIVA GREGORIO RODRÍGUEZ GÓMEZ JAVIER

5 (P DEL S 251) LEY NÚM 73 24

OBRAZAC 1 OBRAZAC POPUNITI ČITKO NA SRPSKOM JEZIKU KORISTEĆI

NAME BIOLOGY 52 CELL AND DEVELOPMENTAL

NAME BIOLOGY 52 CELL AND DEVELOPMENTALLOGO SCHULE MUSTER AUFTRAG VERANTWORTLICHER KULTUR SCHULPOOL AUFTRAG VERANTWORTLICHER

LYCÉE ALBERT CAMUS FIRMINY ACTIVITÉ LES ONDES STATIONNAIRES

LYCÉE ALBERT CAMUS FIRMINY ACTIVITÉ LES ONDES STATIONNAIRESA GLOSSARY OF PARTICLE PHYSICS TERMS TERM DEFINITION ALICE

M SC GISELA KOPPER ARGUEDAS RESUMEN CV

EL APARATO DIGESTIVO Y SUS PROBLEMAS DR MANUEL LOZANO

PNUMACMSCOP11DOC4ANEXO 1REV2 CMS CONVENCIÓN SOBRE LAS ESPECIES

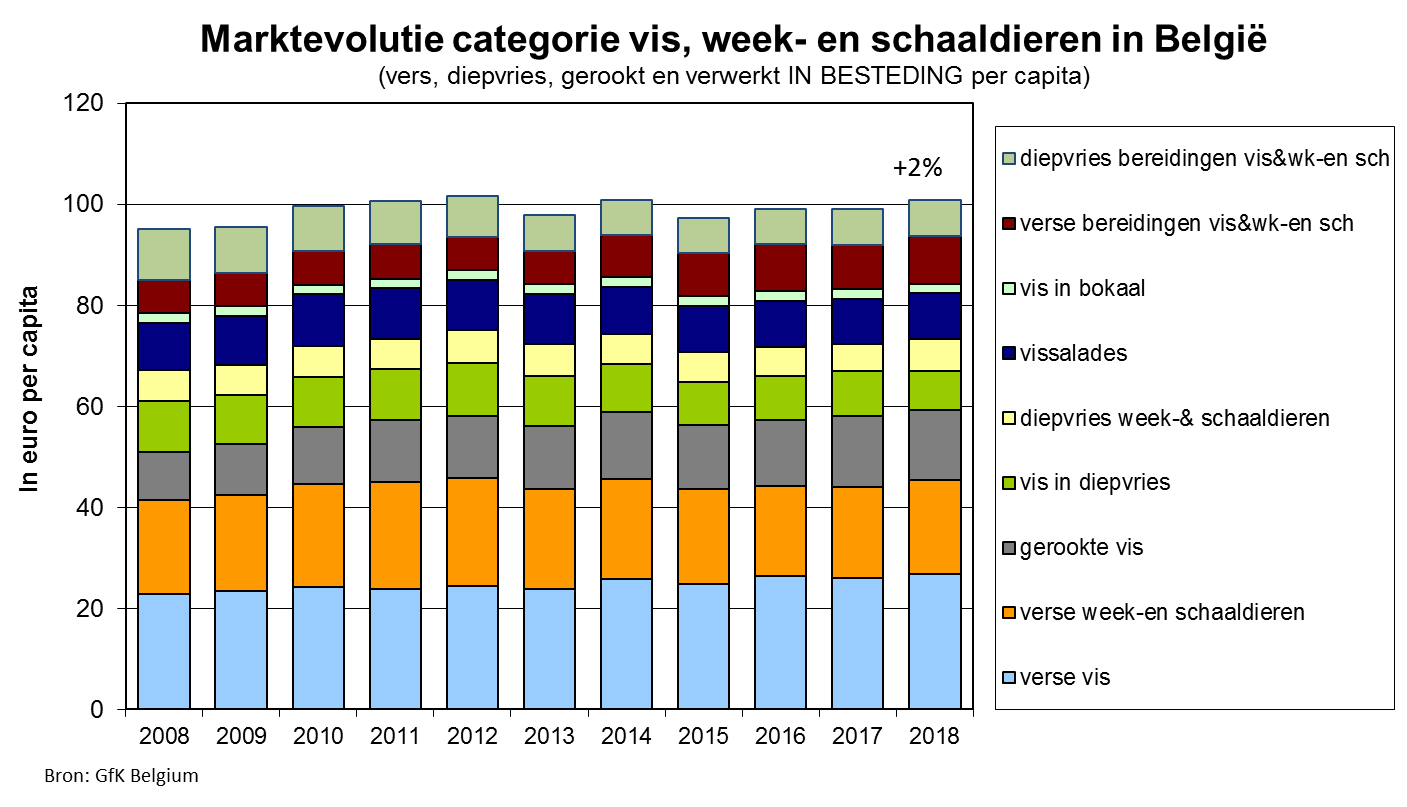

PNUMACMSCOP11DOC4ANEXO 1REV2 CMS CONVENCIÓN SOBRE LAS ESPECIES  STIJGENDE VISBESTEDINGEN MAAR DALEND AANKOOPVOLUME BUITENSHUISCONSUMPTIE NEEMT TOE WE

STIJGENDE VISBESTEDINGEN MAAR DALEND AANKOOPVOLUME BUITENSHUISCONSUMPTIE NEEMT TOE WESAMPLE USE YOUR INFORMATION ENROLLMENT AGREEMENT SCHOOL NAME

TÍTULOS DE MÁSTERS UNIVERSITARIOS OFICIALES PENDIENTES DE RECOGER (ACTUALIZADO

COMPETITIVIDAD SISTÉMICA NUEVO DESAFÍO A LAS EMPRESAS Y A